近期海外市场出现了剧烈动荡,对A股市场的反弹构成了较大压制。同时随着我国货币政策微调,新股发行节奏一直保持高速,资金失衡成为硬伤,导致A股新年以来持续回落,上证指数不仅跌破半年线,3000点关口也告失守。同时中登公司数据显示A股持仓账户数创新高说明主力机构不断减持,连续下跌后反弹无力进一步挫伤投资积极性,量价齐落表明重心下移已成定局。在相对弱势环境下,A股对于利好反应迟钝而对利空敏感,再度出现对外围股市跟跌不跟涨的怪圈。 数据表明国内经济趋稳,通胀预期降温;而在春节来临之际,公开市场的净投放和月初银行信贷较大的贷款规模保证本周市场不存在资金面压力;从上周政府的政策和言论看,除去针对房地产市场外,政策因素对市场的影响由前期的利空逐步转向利好。 国际市场方面:上周美元指数震荡上行,接近我们的目标位81,预计本周震荡调整概率加大;大宗商品市场继续回落,较最高点回落15%-20%,预计跌幅将减缓;道指上周冲高回落,从周线看后市仍不乐观;港股上周五再创新低,预计后市跌幅将加大。 本周是春节长假前的最后一个交易周,资金面压力、海外市场波动、政策收紧预期三大因素使得延续弱势震荡。 根据浙商证券的基金仓位监测模型,偏股型开放式基金平均仓位在上周出现一定幅度下滑,由前一周的81.19%下降至78.69%,平均仓位下降2.50%。剔除市值波动对基金仓位的影响,基金整体主动减仓2.09%,其中选择主动减仓的基金占比67.61%。

作为节前最后一个交易周,或许因预期而存在红包行情,但弱势反弹难有起色。目前资金聚焦区域概念,继海南、新疆、西藏后,广西、青海、天津再次被发掘,区域投资题材仍是短期方向。此外,我们认为中小板和创业板次新股、科技类应是春节前后个股机会所在。 伴随着国内政策面和资金面的逐步好转,市场回暖信心在增强,短期影响股指波动的主要因素在于欧洲债务问题带来的全球资本市场的避险情绪。我们认为春节前国内市场主要以平稳为主,在策略配置上主要以政策支持和业绩增长的确定性为主线,配置受益于春节来临带来的消费和旅游旺季的食品饮料、餐饮旅游、商业零售行业以及政策面利好的农业板块。同时抓住可能即将出台的区域振兴政策的相关区域性板块的投资机会,如广西,西藏,新疆等;中短期内,受益于产业升级的社会服务业、低碳经济等也可以积极关注。 我们认为,大盘未来1-2个月内会呈现弱势,继续震荡向下寻求支撑的可能性较大。大盘最后的企稳依赖于蓝筹股走势,目前看来,以石化、金融和地产为主的大盘蓝筹还没有止跌迹象。从中期走势看,大盘下跌的第一目标位是去年10月9日留下的跳空缺口2850点附近,预计本周能够到达这一位置,本周波动区间为2850-2980点。鉴于市场中期走势偏淡的判断,建议投资者继续采取谨慎的投资策略,波段操作,降低投资仓位。本周热点将分布在中小盘题材概念股中,推荐友谊股份、荣信股份、中青旅、同仁堂。 就目前情况来看,信用风险冲击下国际市场动荡加大,由欧洲各国引起的主权信用风波还将继续上演,全球风险偏好将下移,春节期间海外市场仍有下挫风险;资金面压力是年初市场调整的主要原因之一。从全年来看,政府明确要求扩大直接融资规模以及银行股的巨额再融资是市场中长期供应压力的来源。从短期来看,春节前后基金分红和新股密集上市态势不改,还将继续分流市场资金,持续给市场造成抽血效应;在没有政策调控放松信号出现之前,市场难以出现强劲反弹,指数还有下行空间。而在各种负面消息共振下,前期涨幅居前、估值较高的中小盘股面临较高风险,我们建议投资者还应该继续谨慎,保持较低仓位度过春节长假。 由于去年8月份以来小盘风格持续强势,导致结构性估值泡沫显著。随着小盘股高增长的业绩和送转题材的逐步兑现,市场筹码派发欲望也逐渐趋强。尤其在大盘出现破位趋势性下跌情况下,小盘股板块的补跌行情可能进一步展开。而由于去年IPO重启以来新股发行市盈率越走越高,次新股泡沫在大盘趋势转弱情况下已呈现加速释放之势,投资者应适当回避。

本周是春节前最后一个交易周,由于长假因素,市场交投将有所趋淡,尤其在后半周成交将明显萎缩,市场期望的反弹行情估计难以在节前展开,市场若能探底企稳已属不易。

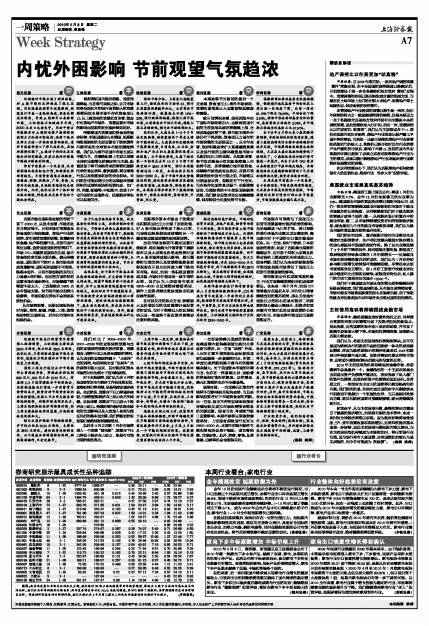

民生证券看 平 中原证券看 多 东吴证券看 平 国盛证券 看 空 招商证券看 多

近期市场在指标股走软的带动下直下3000点,从技术面看,市场还处在寻底过程中。目前市场对政策面及资金面依旧相当敏感,房地产行业的调控、货币信贷政策的调整,直接影响到金融、地产等权重行业。在货币发行高位回落、信贷速度受到控制情况下,市场IPO、再融资速度却在加速,场内资金的供求关系出现失衡。美元持续走强、国际股市下跌对A股市场也形成直接影响,国际板的威慑不可忽视。除基本面外,目前市场面临的其他压力是最大的时候。但这些方面的制约因素市场在逐步消化,市场继续下跌幅度不会太大,上证指数在2800点会有很强支撑。但节前市场交投将比较清淡,市场即使反弹也不会形成系统性机会。 由于已逐步临近春节长假,而且基金仓位将近9成,后续持续加仓空间不大,市场缺乏推动大盘股持续上扬的资金。在当前市场背景下,股指能否再度走强依然要看未来宏观数据以及蓝筹股业绩的增长情况,以及春节后资金面紧张的情况能否有效缓解,而欧美市场能否有效止跌企稳同样非常重要,投资者依然需要耐心等待。从近期管理层透露的信息来看,节后出台利好政策的概率正在加大。 近期海外资本市场由于政策变化和获利回吐压力出现了剧烈动荡,对A股市场反弹构成了较大压制,而导致此轮股指快速调整的另一个重要原因就是政策的超预期调控。 经过前期的集中释放,市场对包括货币政策、房地产政策、融资等均有了心理准备。国内因素导致A股市场继续向下调整幅度不会太大,而国际环境继续恶化则可能拖累A股市场继续调整。但市场大幅向上也存在较大难度,除非有重大利多推动。因此近期市场仍将保持震荡探底态势,而中期则可能保持区间震荡格局。近几日指数跌势趋缓,并在2900-3000点之间展开争夺,向下逐渐接近年线(2870点附近)。该区域将非常关键,如果能就此止跌,市场信心将得到较好维护,如果跌破则将继续大幅向下。 市场很有可能高估了通胀压力和货币政策紧缩对经济趋势的影响。无论是美国PMI的扩张、进口指数的提升还是失业率见顶回落态势,毫无疑问对于中国的出口复苏都是好征兆。另一方面,相对于欧洲、日本更强劲的数据,促成了近期美元指数的继续回升,这有助于抑制大宗商品价格过快的上涨速度和全球通胀压力。综合判断,我们认为未来的新数据很可能证实前期市场高估了通胀压力和货币政策紧缩的影响。

从市场表现看,近期区域板块相对活跃,海南、新疆、西藏、上海、滨海轮动特征比较明显,后市仍可能存在短线机会。 总体来看,由于国内市场基本面及流动性继续向好,不支持股市持续大幅走低。随着市场做多信心的逐步提升,后市A股保持宽幅震荡的可能性较大。我们对后市中期谨慎看多,中长期投资者应该保持持股耐心等待的思路,建议逢低关注通胀预期下、基本面比较确定、存在高比例送配的中小股的投资机会。另外,随着经济持续复苏,受益通胀预期品种也可适当关注。 当前市场面临的不确定因素仍然较多,特别是美元升值背景下美欧股市以及大宗商品价格走势将对国内A股市场形成较大影响,然而蓝筹的估值优势以及政策维稳意图使得股指在目前点位再度大幅下跌空间有限。相反,如果一些积极因素形成共振,市场仍有望迎来一波不错的反弹。我们认为上证综指有望在2800-3000点区域维持震荡格局,操作上投资者需注意快进快出和波段操作原则。 本周华泰证券发行将考验资金面;1月宏观经济数据将公布,CPI将成为货币政策进一步动作的主要参照;股指期货交易规定等有望公布。另外,中美贸易、汇率乃至政治交锋也值得关注。预计本周市场将保持震荡探底态势,上证指数较大概率运行区间点位为2850-3000点。 等待数据公布和悲观预期的修正,行业方面继续推荐航空和必须消费品。在未来一两个月内,如果CPI能够稳定在温和水平,同时出口能够继续当前的复苏趋势,那么无论是对通胀压力的担心还是对经济二次探底的担心都会大幅减小,投资者和政府都有可能对此前过度恐慌的心态进行纠正,市场也将有望因此而逐渐筑底回升。

在可供关注的热点方面,跌幅较大且价值低估的优质蓝筹仍是投资者的首选,而对于涨幅巨大的区域板块以及一些强势个股投资者则需要注意补跌风险。

齐鲁证券看 空 中投证券看 平 中金公司 看 空 信达证券 看 平 广发证券看 多

近期股市因央行收紧货币信贷陷入短期调整,上证指数支撑位在2800点附近,阻力位在3200点附近。我们认为,只有调控政策被市场充分消化,通胀压力明显缓和后市场才能恢复上升趋势。 我们对比了2003-2004年、2007-2008年的宏观调控政策与当前的宏观调控政策在经济背景、政策指向、调控行业以及涉及部委的情况,认为当前的宏观调控属于“点刹车”式的调控,与前两轮全面“急刹车”式的调控有较大区别,其对经济和资本市场的冲击也将小于前两轮调控。 上周市场一度反弹,但最终在外围市场显著回调影响下再次下探,全周震荡走低,欧洲部分地区暴露出的债务问题是导致外围市场大幅下挫的主要原因。 一方面强势美元造成的资金回流美国境内使得美联储加息时点将会更为滞后,另一方面“热钱”外流、人民币汇率升值预期也会促使我国更加延缓进一步紧缩的时点,所谓二季度加息判断纯属子虚乌有的概率越来越大。对于我国资本市场的环境而言,也许在一阵紧缩之后,面临着的将是相对宽松的氛围。这样看来,美元汇率惹的也许不全都是祸。 展望未来,政策面上,结构调整已是迫在眉睫的大事,管理层将会在保持宏观经济政策稳定性和连续性的同时,加大力度进行经济发展方式转变;基本面上,本周关注的重点将是1月份宏观经济数据(货币供应量和存贷款、PPI、CPI等);流动性方面,春节临近,央行加大货币投放力度,向市场释放流动性以缓解流动性方面的压力;投资者情绪方面,近期新增A股开户数以及基金开户数稳步回升;另外,春节长假临近,市场也将会关注长假期间消费的表现,可能会给消费板块带来一定的支持;结合历史上春节前股指表现,我们认为市场短期有望小幅反弹。

最近三周央行通过公开市场操作大量投放资金,净投放分别达到880亿元、860亿元和2140亿元。考虑到2、3月通货膨胀水平仍然高企,为控制通胀央行有进一步收紧货币信贷的压力,投资者对市场资金面仍应保持谨慎;近期上市公司大股东纷纷减持股份,对股价形成明显压力;上周区域经济板块炒作继续升温,但上周五海南板块剧烈震荡,区域经济板块风险加大。 对于本轮调控,我们认为在4月初发改委制定全年经济工作具体规划前,紧缩态势仍将持续,但是程度会逐步减轻。在此阶段,政策向下压力将逐步减轻,而调控使得经济向上动力也有所减缓。总体来看,政策向下压力要大于经济向上动力。考虑到海外经济和股市波动的负面影响以及大盘进入合理估值区间后的基本面支撑,我们判断此阶段股指仍然维持弱势震荡格局。 A股市场即将迎来春节长假,而海外市场走势震荡,市场可能因为回避假日期间海外市场的不确定性而依然保持审慎,加仓意愿不足。短期即使反弹,其力度可能也不会太强。节前市场成交量可能趋于清淡,风险偏好不足可能使得防御性板块仍将好于大盘,节日消费、区域开发、三网融合、世博会、业绩与“高送转”概念和个股仍将是局部活跃的热点。 展望本周,一方面美元汇率如何演绎不仅影响相关板块走势,而且会影响投资者对于市场资金面的判断。另一方面,层出不穷的区域板块能否持续活跃又成为市场热情能否维系的关键因素。综合而言,考虑到节假日因素影响,本周市场将呈现弱势震荡格局,上证综合指数运行区间为2800-3000点。本周不排除有新的主题投资板块会盘中崛起,诸如粤港澳、世博会等。此外,消费、零售、品牌服装、白酒等机会也值得关注。 行业配置方面,我们仍看好银行、保险、食品饮料(高端白酒)、信息技术和零售等行业。另外建议持续关注主题投资中的新疆、成渝、上海等区域经济板块。

预计本周沪深股市将继续调整,沪市阻力位在3050点附近,支撑位在2850点附近。建议投资者控制仓位,以个股基本面调整持仓结构,短线滚动操作,半仓过春节。 其后在4月之后到7月份市场将进入一个政策“真空期”,政策向下压力将低于经济向上动力,股指有可能出现阶段性高点。 通胀未出现大幅上升、政策作用下基本面依然稳健、外围市场稳定等是市场摆脱目前低迷态势的条件,目前这些条件并不具备,2月底、3月初是一个可能的观测时间窗。政策预期、政策执行效果以及海外市场走势是需要密切关注的三个方面。 (编辑 姚炯)