随着融资融券相关制度的渐趋完善,也就意味着融资融券这一金融创新措施的推出日期越来越近,这可能也是昨日广发证券等券商股一度活跃的诱因。正因为如此,有观点认为融资融券标的股活跃度有望提升。

对此,笔者认为不宜过分夸大金融创新对个股活跃度的推动力。一是因为在融资融券推出之初,相关券商会持相对谨慎态度,对客户的交易行为会有一个观察期,而且客户本身也需要一个熟悉阶段。也就是说,融资融券推出后市场会有一个观望周期,从而对融资融券标的股的推动力相对有限;二是因为融资融券作为金融创新措施,对个股股价的影响力主要体现在二级市场,并不影响相关上市公司的经营。而众所周知的是,对上市公司二级市场股价,尤其是对于蓝筹股的股价来说,真正的推动力不是来源于二级市场的交易者行为,而是来源于上市公司业绩改善的驱动力。因此,融资融券并不会改变融资融券标的股的估值核心。

当然,从海外市场经验来看,融资融券可能会对相关个股股价短线走势产生一定程度的影响力,因为融资融券会影响相关机构的短线仓位配置心态。比如说获得融资融券资格的券商为了未来的融券业务,可能会在一定时间内加大相关融资融券标的股的加仓力度,以提升“库存”,如此就会对相关个股的短线走势形成一定的买盘推动力。

与此同时,当前机构的操作思路也渐有向主题投资转移趋势,即机构资金开始追捧所谓的题材股。而融资融券推出后机构或将把注意力转移到相关蓝筹股上来,如此就会使得部分标的股走势趋于活跃。

综上所述,融资融券可以激活标的股二级市场股性,扩展股价波幅空间,但并不会改变此类个股的运行方向,因为改变个股股价运行方向的力量来源于上市公司的业绩成长趋势而不是金融创新措施。循此思路,建议投资者密切关注那些基本面积极向上的个股,因为金融创新的题材催化与上市公司业绩基本面的积极变化如果形成一定的共振效应,就将推动二级市场股价活跃。就目前的融资融券标的股来看,可密切关注两类品种:一是资源、能源类股,此类个股将受益于我国经济增长,业绩稳定成长趋势较为乐观,比如说长江电力、冀中能源、神火股份等。二是近年来经营处于景气旺盛周期股,中国南车、上海电气、华兰生物等就是如此。

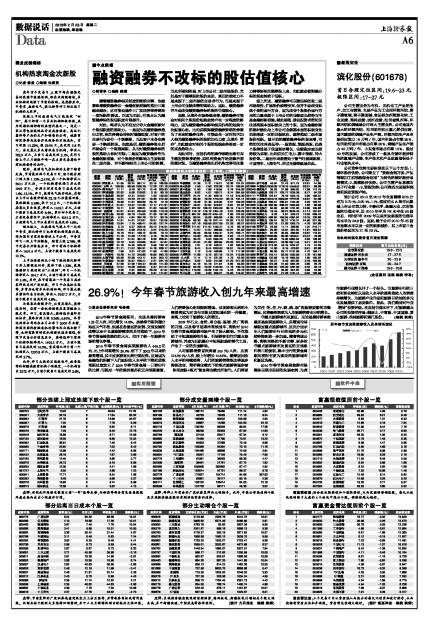

融资融券试点初期标的股一览(制表:上海聚源数据)

股票 股票 总股本 流通 总市值(亿元) 机构持股占流通股比(%) 2009年 股票 股票 总股本(亿股) 流通 总市值(亿元) 机构持股占流通股比(%) 2009年 股票 股票 总股本(亿股) 流通 总市值(亿元) 机构持股占流通股比(%) 2009年

简称 代码 (亿股) 股本 振幅(%) 简称 代码 股本 振幅(%) 简称 代码 股本 振幅(%)

(亿股) (亿股) (亿股)

000001 深发展A 31.05 29.24 697.17 33.75 188.68 000932 华菱钢铁 27.38 11.21 175.21 10.39 124.07 002024 苏宁电器 46.64 31.43 871.73 22.81 44.89

000002 万科A 109.95 96.56 1030.25 17.26 131.16 000933 神火股份 7.50 7.50 222.38 23.74 196.94 601988 中国银行 2538.39 1778.19 10483.56 96.61 68.68

000024 招商地产 17.17 6.46 391.72 12.49 200.83 000937 冀中能源 11.56 7.88 416.55 9.78 245.00 600048 保利地产 35.20 31.88 685.29 17.98 113.75

000027 深圳能源 22.02 5.99 278.62 3.16 80.19 000960 锡业股份 8.02 4.01 180.71 8.74 304.55 601006 大秦铁路 129.77 129.77 1235.39 8.77 64.33

000039 中集集团 26.62 12.31 370.07 1.63 130.00 000983 西山煤电 24.24 11.32 826.10 11.43 275.30 601111 中国国航 122.51 78.46 1323.15 2.60 156.34

000060 中金岭南 10.24 10.23 241.61 10.38 312.30 600000 浦发银行 88.30 79.26 1749.23 33.19 134.41 601398 工商银行 3340.19 2509.62 16400.33 48.67 64.68

000063 中兴通讯 18.90 14.67 803.09 25.76 72.79 600005 武钢股份 78.38 31.35 540.05 6.01 159.20 600018 上港集团 209.91 209.91 1150.30 2.33 120.24

000069 华侨城A 31.07 13.37 474.20 17.17 211.61 600015 华夏银行 49.91 37.84 540.97 6.87 81.84 601628 中国人寿 282.65 208.24 7939.56 1.62 80.58

000157 中联重科 19.71 8.22 460.24 21.83 159.92 600016 民生银行 222.62 188.23 1620.69 39.15 115.47 601166 兴业银行 50.00 50.00 1704.00 42.99 195.82

000402 金融街 24.81 24.81 264.50 12.86 113.40 600019 宝钢股份 175.12 175.12 1404.46 3.24 120.25 601318 中国平安 73.45 39.27 3678.40 41.17 134.97

000527 美的电器 20.80 20.78 415.00 21.60 187.92 600028 中国石化 867.02 699.22 9754.02 2.09 122.50 000338 潍柴动力 8.33 2.81 529.73 13.33 268.40

000538 云南白药 5.34 4.84 304.78 13.77 83.75 600029 南方航空 80.04 15.00 505.03 4.85 131.03 601328 交通银行 489.94 159.55 4051.84 10.15 130.80

000562 宏源证券 14.61 14.61 313.87 70.67 132.05 600030 中信证券 66.30 65.70 1811.44 22.83 112.91 601600 中国铝业 135.24 39.31 1720.31 24.50 231.05

000568 泸州老窖 13.94 7.15 485.47 24.52 127.74 600036 招商银行 191.19 156.59 3017.06 27.26 96.21 601919 中国远洋 102.16 21.63 1309.73 4.76 167.86

000623 吉林敖东 5.73 5.07 290.46 20.43 215.04 600050 中国联通 211.97 211.97 1403.21 5.70 69.18 601168 西部矿业 23.83 17.11 308.60 7.34 219.71

000630 铜陵有色 12.94 5.58 243.73 3.24 273.23 600089 特变电工 17.97 17.97 388.59 15.61 64.02 002142 宁波银行 25.00 10.54 381.25 11.81 163.97

000651 格力电器 18.79 18.51 456.12 32.65 79.73 600104 上海汽车 65.55 65.55 1390.31 6.23 406.71 601169 北京银行 62.28 39.55 989.56 49.87 119.64

000652 泰达股份 14.76 14.59 117.46 3.75 78.79 600320 振华重工 43.90 25.48 396.00 2.52 74.41 601939 建设银行 2336.89 90.00 13296.91 23.42 78.06

000709 河北钢铁 68.77 37.54 397.48 8.06 208.94 600362 江西铜业 30.23 3.53 1085.20 2.29 389.57 601088 中国神华 198.90 18.00 5853.52 2.93 138.82

000729 燕京啤酒 12.10 5.04 246.65 15.51 57.07 600383 金地集团 24.84 21.82 306.55 23.20 191.39 601857 中国石油 1830.21 40.00 23811.03 0.41 62.43

000768 西飞国际 24.78 15.25 333.49 3.58 130.10 600489 中金黄金 7.91 3.76 406.37 4.82 166.35 601390 中国中铁 213.00 46.75 1222.61 4.13 42.25

000783 长江证券 21.71 11.07 384.31 14.78 208.77 600519 贵州茅台 9.44 9.44 1633.62 18.01 75.49 002202 金风科技 14.00 6.15 423.92 6.51 82.89

000792 盐湖钾肥 7.68 3.91 421.62 11.80 47.86 600547 山东黄金 7.12 3.46 498.86 7.13 117.38 601601 中国太保 86.00 25.77 2137.96 4.72 159.71

000800 一汽轿车 16.28 14.12 340.80 18.05 283.70 600550 天威保变 11.68 5.72 327.16 12.24 113.68 601899 紫金矿业 145.41 63.25 1250.55 1.79 151.66

000825 太钢不锈 56.96 22.89 443.17 5.04 253.73 600598 北大荒 17.14 17.14 231.28 4.79 52.00 601898 中煤能源 132.59 15.18 1569.83 1.55 155.02

000839 中信国安 15.68 15.67 225.47 2.21 224.16 600739 辽宁成大 9.02 9.02 314.66 21.20 247.36 601958 金钼股份 32.27 6.46 567.56 3.18 163.55

000858 五粮液 37.96 37.96 1120.57 60.69 144.30 600795 国电电力 54.48 54.48 371.54 8.60 55.83 601186 中国铁建 123.38 24.50 1062.26 3.00 26.79

000878 云南铜业 12.57 10.08 328.00 5.37 377.37 600837 海通证券 82.28 40.02 1430.82 11.18 139.45 601668 中国建筑 300.00 120.00 1284.00 3.40 33.13

000895 双汇发展 6.06 2.94 339.30 26.29 67.54 600900 长江电力 110.00 49.09 1401.40 5.46 26.48 601766 中国南车 118.40 30.00 651.20 3.58 40.60

000898 鞍钢股份 72.35 18.08 882.65 3.37 174.67 002007 华兰生物 3.60 3.60 205.27 15.03 115.97 601727 上海电气 125.08 21.26 1124.44 0.52 120.58