公司预计09年净利润增长超过50%以上,市场扩张和地产项目为业绩注入持续发展动力,未来股价表现的催化剂来自义乌国际贸易试验区的成功获批带来商铺价值的大幅提升,以及租金上涨空间的实质性放大。技术上看,目前该股放量向上突破,可跟进。 公司是以黄金为主导产业,集矿产资源勘探、开采和冶炼为一体的综合性矿业生产商;公司拥有的丰富的金、铜、锌等有色金属矿产资源,拥有一定的成本优势。近期国际黄金期货市场波动可能频繁,将增加其波动性机会,建议短线投资者积极关注。

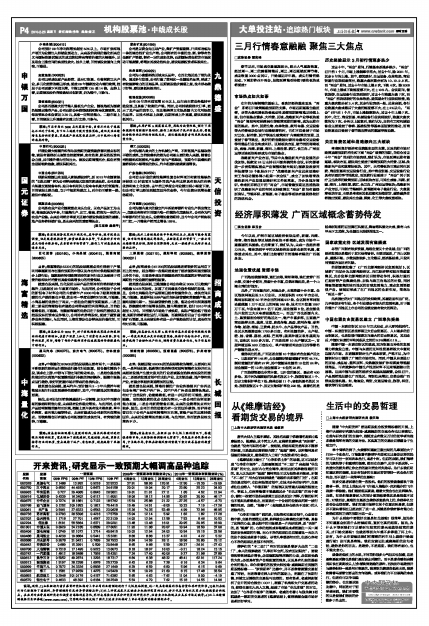

如意集团(000626) 兰州黄河(000929)

公司已形成农副产品经营、进出口贸易、生物制药三大产业,多元化经营战略已形成。受益09年国家拉动内需的政策,控股子公司贡献下利润大增,年报已预增13.5至14倍。走势上看,近期该股股价突破盘局后创新高,仍为慢牛,可参与。 公司为小盘酿酒类区域龙头品种,在西北地区处于领先优势。通过多年发展,公司打造了黄河这一全国驰名品牌,形成了有较强影响力的区域品牌。近期该股稳步震荡上扬,技术形态趋于好转,建议逢低积极关注。

国栋建设(600321) 银鸽投资(600069)

公司是西部最大的节能人造板生产企业,国栋地板为国家免检重点推荐产品,公司近期公告获得退税和购电优惠政策。其每股资本公积金高达3.39元,具备一定转送能力。二级市场上看,目前该股上升通道有加速上行之势,可参与。 公司09年净利润预增50%以上,近年来主营业务维持平稳发展,且具备了较高的产能。同时,公司持续获得大订单,显示了其产品的竞争力,而且银鸽牌文化纸是国内文化用纸领先品牌。从技术形态上来看,近期形成上升通道,建议积极逢低关注。

策略:节后市场以3000点为震荡中轴,当前不必过于悲现也不必过于乐观,自下而上选股个股为重要策略。建议关注业绩增长良好的消费类、区域或产经政策受益品种,以中线耐心持有的态度对待。 策略:本周沪深A股震荡反弹,周线为放量阳线,预计下周初股指仍有继续冲高动作,操作上短线对于技术形态走好、量能配合较佳的品种进行短线关注,建议稳健投资者仍采取战略观望为佳。

国元证券 中国石化(600028) 柳工(000528) 天信投资

伴随业绩大幅提升和作为股指期货融资融券套利重点标的物,该股有望得到主流资金挖掘青睐,安全性高,阶段性投资机会凸显,后市涨升潜力空间巨大。该股近期调整充分,低位有资金进场吸纳迹象,建议积极关注。 公司为国内最大的土方机械生产商,不断拓展产品链取得不错的成果,当前装载机依然为公司最主要的收入来源。随着公司挖掘机和起重机产品线扩张与产能释放,预期今年装载机销量将保持小幅增长的势头,汽车起重机继续高速增长。

中国北车(601299) 广东榕泰(600589)

现阶段我国已全面进入高铁建设时代,到2012年全国高铁的“四纵四横”将为公司带来跨越式发展的高成长期。公司是国内轨道交通装备电机、油田电机和风力发电电机最大的制造商。目前该股止跌企稳,立于中短期均线之上,后市仍可看高一线,建议中线标配。 公司自主研发的高性能弹性复合材料项目和高性能绿色环保型IC封装项目与国外同类产品相比将具有较大的价格优势和本土化优势。去年前三季度公司业绩出现小幅度下滑,但公司订单已经呈现触底回升的态势,今年业绩出现增长值得期待。

顺鑫农业(000860) 万向钱潮(000559)

公司是农业产业化国家重点龙头企业,以农产品加工为主体,物流配送为平台,打造集生产、加工、物流、销售为一体的大农业产业链。未来公司将分享顺义区城市建设快速发展的盛宴,地产业务将持续扩张,是未来利润的重要增长点。 公司为国内最大的独立汽车系统零部件专业生产供应商之一,底盘业务拥有目前国内唯一的模块化底盘技术。公司作为汽车零部件的行业龙头,业绩增长值得期待,且今年公司产销实现开门红,一月整体产销同比增长188%。

(国元证券 姜绍平)

策略:受宏观经济政策的不确定性,虎年伊始,股市就受压调整,但是随着股指期货、融资融券推出在即,节后按耐多时的虎头行情必将启动。在当前的市场背景下,操作上可对惠农板块适当关注。 策略:技术上看短线面临半年线附近压力,股指可能会有震荡,但市场仍将延续反弹格局。在经济复苏的背景下,一些公司业绩将明显好转,高增长值得期待,关注一些逐步从底部开始走强的品种。

海富精选 巨化股份(600160)、小商品城(600415)、豫园商城(600655) 三维通信(002115)、星湖科技(600866)、凌钢股份(600231) 招商成长

点评:海富精选(162301)的选股思路重点关注得益于产能利用率提高而存在涨价预期的中游以及存在相对供给瓶颈的部分上游行业;国家经济转型政策扶持的新兴行业以及受益于消费升级和农村消费而具备持续增长力的消费领域。 点评:招商成长 (161706)的选股思路是将较多的运用自下而上的方法,适当增持一些能明显受益于经济复苏和通货膨胀上升的个股,主要是考虑当前我国经济的快速复苏所带来的强周期性个股业绩的强弹性因素。

就重仓股来说,巨化股份主导产品的制冷剂价格持续大幅飙升,已经超过08年最高市场价。与此同时,公司控股子公司的浙恒电子材料公司的内首家年产6000吨电子级高纯氢氟酸的生产线前景也不错,故公司一季度业绩相对乐观,可跟踪。小商品城的优势在于两点,一是租金的提升预期强烈,二是三期二阶段的商辅招租有望给公司带来新的利润增长点,目前估值略低估,可跟踪。而豫园商城的优势则在于股权的重估以及控股股东的资本运作能力,公司持有券商股权,受益于融资融券业务的推出,与此同时,上海世博会也会带来股价催化剂,可积极跟踪。 就其重仓股来说,三维通信公司公告称以3069万元收购广州逸信50.5%的股权,加速了在网络优化服务领域的发展。而且,公司在网络优化产品领域已经有较强竞争力,成长空间乐观,可跟踪。星湖科技主导产品的呈味核苷酸和苏氨酸产能、质量均居国内第一。呈味核苷酸价格上涨,驱动公司利润高速增长。苏氨酸全球市场增长很快,国内增速更高,估计2010年或超过5万吨。目前国内市场处于成长期,实际产能远低于理论值,短期价格将高位运行,可跟踪。而凌钢股份则由于公司拥有铁矿石资源,且未来该业务有进一步产能拓张的计划,成长空间相对乐观,可跟踪。

策略:该基金认为2010年,对于宏观刺激政策退出抑或转向的忧虑日渐增加,在资产配置上加大了消费行业如医药、家电等的配置,同时,增持了部分产能利用率迅速提高的价格敏感性中游行业。 策略:该基金认为支撑A股市场的基本面因素仍然较为强劲,一季度采取更加灵活的投资策略,保持中性仓位水平。同时,逐步减持了金融和地产行业,增持消费与服务行业、电子信息行业。

中海量化 星马汽车(600375)、东方电气(600875)、吉林敖东(000623) 博瑞传播(600880)、恒瑞医药(600276)、泸州老窖(000568) 长城回报

点评:中海量化(163906)的选股思路主要有两个,一是根据不断更新的经济运行数据进行量化行业配置,结合量化精选个股,谋求在上游、中游与下游之间的轮动机会。二是结合基金契约规定的大类资产配置模型进行积极的择时操作,跟随市场热点运行趋势,较好的把握市场所带来的各类机会。 点评: 长城回报(162005)的选股思路较为清晰,主要关注两类,一是科技创新、低碳等对经济转型和结构调整有支持并对未来经济发展产生重大意义的行业是该基金选择成长股的的重点;二是经济发展过程中的支柱产业,比如说金融、地产等相关产业,有望分享经济高速增长的回报。

就其重仓股来说,星马汽车:预计国内2-3年内搅拌车和散装水泥车行业发展趋势依然看好,其中,中西部地区的增速会更高。 就其重仓股来说,博瑞传播的广告业务除报刊广告外还包含电视广告和户外广告。其中户外广告是业绩增长亮点。相对于当前股价,估值略偏低,有进一步回升的可能性,建议跟踪。而恒瑞医药的优点也较为突出,一是公司的仿制创新能力极强,二是公司新药储备乐观,未来的业绩增长点相对较多,因此,公司目前的估值仍有一定的回升趋势。而泸州老窖则在于公司产品结构调整相对乐观,高端产品的比重持续回升,未来的业绩增长前景乐观。与此同时,华西证券股权也增色不少。

据此,公司计划对销售渠道进行一定调整,加大对中西部市场的渗透和销售力度,未来现有业务稳定增长。与此同时,公司产品结构调整前景相对乐观,混凝土泵车具有技术壁垒高、单车价格高、盈利能力强等特点,未来有望成为公司新的利润增长点。而收购整合则有望为公司拓展新的成长空间,有突破的趋势,可跟踪。

策略:该基金积极观察大盘股的动向,谋求风格适时进行较为均衡的配置。重点增加了建筑建材、交通运输、机械、医药生物等行业的配置,重点减持了地产、有色配置,适度减持了采掘行业。 策略:该基金认为,在经历09年大幅上涨的情况下,要谨慎看待市场,从经济结构调整的大背景下,寻找基本面优秀的公司,中长线布局,争取在控制风险的前提下努力改善基金的投资绩效。