(上接B34版)

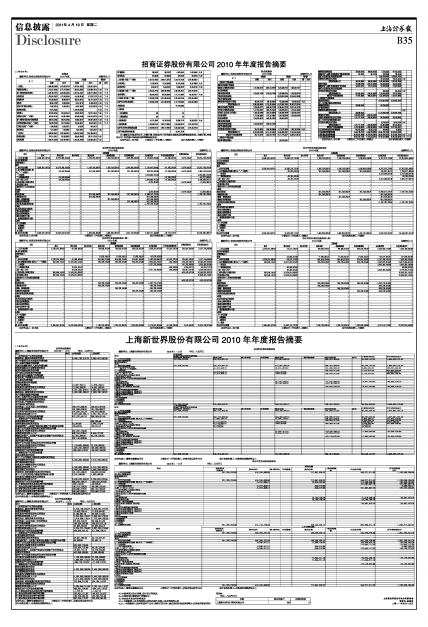

利润表

编制单位:招商证券股份有限公司 2010年度 金额单位:元

| 项 目 | 本期金额 | 上期金额 | 附注编号 | |||

| 合并数 | 母公司 | 合并数 | 母公司 | 合并 | 母公司 | |

| 一、营业收入 | 6,486,468,308.63 | 5,979,533,527.93 | 8,679,951,925.00 | 7,384,152,437.61 | ||

| 手续费及佣金净收入 | 5,110,457,473.40 | 4,771,279,324.93 | 7,326,253,288.56 | 5,542,684,732.14 | 六、34 | 二十、8 |

| 其中:代理买卖证券业务净收入 | 3,578,766,778.75 | 3,324,960,532.33 | 4,792,755,253.97 | 4,586,771,288.39 | 六、34 | 二十、8 |

| 证券承销业务 | 1,224,352,798.97 | 1,177,053,361.84 | 515,185,621.84 | 477,078,177.82 | 六、34 | 二十、8 |

| 财务顾问业务 | 101,036,830.32 | 88,869,995.79 | 338,014,437.05 | 331,171,205.89 | 六、34 | 二十、8 |

| 保荐业务 | 86,645,779.89 | 74,300,000.00 | 73,257,697.13 | 61,948,008.73 | 六、34 | 二十、8 |

| 受托客户资产管理业务净收入 | 71,660,342.14 | 71,660,342.14 | 45,870,830.03 | 45,870,830.03 | 六、34 | 二十、8 |

| 基金管理业务收入 | 12,910,185.02 | - | 1,516,169,873.60 | - | 六、34 | 二十、8 |

| 利息净收入 | 497,600,837.53 | 416,503,250.16 | 246,549,203.70 | 202,211,025.30 | 六、35 | 二十、9 |

| 投资收益(损失以“-”号填列) | 667,561,517.40 | 574,981,949.98 | 992,548,514.48 | 1,581,531,837.38 | 六、36 | 二十、10 |

| 其中:对联营企业和合营企业的投资收益 | 364,970,076.30 | 364,970,076.30 | 114,856,285.17 | 467,651,292.28 | 六、36 | 二十、10 |

| 公允价值变动收益(损失以“-”号填列) | 205,236,192.43 | 213,173,930.04 | 105,030,435.77 | 48,520,256.01 | 六、37 | 二十、11 |

| 汇兑收益(损失以“-”号填列) | -1,698,810.85 | -3,549,325.75 | 18,452.92 | -347,442.79 | ||

| 其它业务收入 | 7,311,098.72 | 7,144,398.57 | 9,552,029.57 | 9,552,029.57 | 六、38 | |

| 二、营业支出 | 2,583,960,365.10 | 2,331,358,090.70 | 3,665,250,014.62 | 2,857,665,607.09 | ||

| 营业税金及附加 | 297,011,089.17 | 292,430,863.32 | 406,445,269.60 | 326,171,119.38 | 六、39 | |

| 业务及管理费 | 2,285,791,395.28 | 2,037,769,296.73 | 3,260,145,299.26 | 2,532,835,041.95 | 六、40 | |

| 资产减值损失 | 338,050.37 | 338,100.37 | -1,802,535.52 | -1,802,535.52 | 六、41 | |

| 其它业务成本 | 819,830.28 | 819,830.28 | 461,981.28 | 461,981.28 | 六、38 | |

| 三、营业利润(亏损以“-”号填列) | 3,902,507,943.53 | 3,648,175,437.23 | 5,014,701,910.38 | 4,526,486,830.52 | ||

| 加:营业外收入 | 29,048,391.25 | 18,244,890.66 | 36,181,426.43 | 36,087,988.98 | 六、42 | |

| 减:营业外支出 | 8,050,537.72 | 8,058,059.47 | 14,346,269.74 | 10,095,417.69 | 六、43 | |

| 四、利润总额(亏损以“-”号填列) | 3,923,505,797.06 | 3,658,362,268.42 | 5,036,537,067.07 | 4,552,479,401.81 | ||

| 减:所得税费用 | 694,645,094.73 | 645,893,680.94 | 1,111,111,456.62 | 910,084,153.17 | 六、44 | |

| 五、净利润(净亏损以“-”填列) | 3,228,860,702.33 | 3,012,468,587.48 | 3,925,425,610.45 | 3,642,395,248.64 | ||

| 归属于母公司所有者的净利润 | 3,228,860,702.33 | 3,012,468,587.48 | 3,727,722,803.65 | 3,642,395,248.64 | ||

| 少数股东损益 | - | - | 197,702,806.80 | - | ||

| 六、每股收益 | ||||||

| (一)基本每股收益 | 0.90 | - | 1.14 | - | ||

| (二)稀释每股收益 | 0.90 | - | 1.14 | - | ||

| 七、其他综合收益 | -62,221,086.61 | -29,760,619.34 | 98,634,770.76 | 86,808,023.42 | 六、45 | |

| 八、综合收益总额 | 3,166,639,615.72 | 2,982,707,968.14 | 4,024,060,381.21 | 3,729,203,272.06 | ||

| 归属于母公司所有者的综合收益总额 | 3,166,639,615.72 | 2,982,707,968.14 | 3,820,403,143.23 | 3,729,203,272.06 | ||

| 归属于少数股东的综合收益总额 | - | - | 203,657,237.98 | - |

注:编制合并报表的公司,只需计算、列报合并口径的基本每股收益和稀释每股收益,无需计算、列报母公司口径的基本每股收益和稀释每股收益。

法定代表人:宫少林 主管会计工作负责人:邓晓力 会计机构负责人:车晓昕

现金流量表

编制单位:招商证券股份有限公司 2010年度 金额单位:元

| 项 目 | 本期金额 | 上期金额 | 附注编号 | |||

| 合并数 | 母公司 | 合并数 | 母公司 | 合并 | 母公司 | |

| 一、经营活动产生的现金流量: | ||||||

| 处置交易性金融资产净增加额 | - | - | - | - | ||

| 收取利息、手续费及佣金的现金 | 7,211,864,913.79 | 6,661,512,967.99 | 8,870,338,727.65 | 7,238,049,778.17 | ||

| 拆入资金净增加额 | - | - | - | - | ||

| 回购业务资金净增加额 | 4,724,613,779.89 | 4,724,613,779.89 | 1,823,438,921.39 | 1,823,438,921.39 | ||

| 代理买卖业务的现金净额 | - | - | 30,623,651,190.68 | 29,185,847,999.89 | ||

| 代理兑付债券的现金净额 | - | - | - | - | ||

| 收到的其他与经营活动有关的现金 | 445,374,975.37 | 324,402,660.52 | 156,030,954.46 | 104,990,902.51 | 六、46 | |

| 经营活动现金流入小计 | 12,381,853,669.05 | 11,710,529,408.40 | 41,473,459,794.18 | 38,352,327,601.96 | ||

| 处置交易性金融资产净减少额 | 3,796,581,522.72 | 3,444,890,917.38 | 13,085,415,701.28 | 12,912,142,171.80 | ||

| 支付利息、手续费及佣金的现金 | 1,577,950,566.27 | 1,458,279,904.59 | 1,208,942,453.75 | 1,216,051,264.08 | ||

| 支付给职工以及为职工支付的现金 | 1,428,513,548.84 | 1,325,652,683.93 | 1,382,346,799.46 | 1,036,084,724.07 | ||

| 支付的各项税费 | 1,175,284,348.58 | 1,121,301,938.47 | 1,342,233,582.68 | 1,055,433,024.39 | ||

| 拆出资金净增加额 | 2,154,650,837.93 | 1,469,085,242.81 | 563,561,906.78 | - | ||

| 回购业务资金净增加额 | - | - | - | - | ||

| 代理买卖业务的现金净额 | 2,104,492,842.27 | 2,946,821,014.69 | - | - | ||

| 代理兑付债券的现金净额 | - | - | - | - | ||

| 支付的其他与经营活动有关的现金 | 925,150,360.05 | 1,345,369,883.45 | 1,773,179,790.96 | 1,283,142,920.59 | 六、46 | |

| 经营活动现金流出小计 | 13,162,624,026.66 | 13,111,401,585.32 | 19,355,680,234.91 | 17,502,854,104.93 | ||

| 经营活动产生的现金流量净额 | -780,770,357.61 | -1,400,872,176.92 | 22,117,779,559.27 | 20,849,473,497.03 | ||

| 二、投资活动产生的现金流量: | ||||||

| 收回对外投资收到的现金 | - | - | 600,510,904.11 | - | ||

| 取得投资收益收到的现金 | 458,660,825.09 | 458,660,825.09 | 2,520,000.00 | 167,900,000.00 | ||

| 处置固定资产、无形资产和其他长期资产而收回的现金净额 | 251,060.81 | 245,721.43 | 199,239.34 | 189,914.34 | ||

| 处置子公司及其它营业单位收到的现金净额 | - | - | 2,340,229,851.60 | 2,628,491,910.50 | ||

| 收到的其他与投资活动有关的现金 | - | - | 126,000,000.00 | 126,000,000.00 | 六、46 | |

| 投资活动现金流入小计 | 458,911,885.90 | 458,906,546.52 | 3,069,459,995.05 | 2,922,581,824.84 | ||

| 投资支付的现金 | 192,444,916.90 | 1,019,751,420.98 | 900,000,000.00 | 100,000,000.00 | ||

| 购建固定资产、无形资产和其他长期资产支付的现金 | 148,479,532.15 | 137,210,019.28 | 123,220,062.53 | 112,810,335.04 | ||

| 取得子公司及其它营业单位支付的现金净额 | - | - | - | - | ||

| 支付的其他与投资活动有关的现金 | - | - | 400,000.00 | 400,000.00 | 六、46 | |

| 投资活动现金流出小计 | 340,924,449.05 | 1,156,961,440.26 | 1,023,620,062.53 | 213,210,335.04 | ||

| 投资活动产生的现金流量净额 | 117,987,436.85 | -698,054,893.74 | 2,045,839,932.52 | 2,709,371,489.80 | ||

| 三、筹资活动产生的现金流量: | ||||||

| 吸收投资收到的现金 | - | - | 10,914,861,624.32 | 10,914,861,624.32 | ||

| 其中:子公司吸收少数股东投资收到的现金 | - | - | - | - | ||

| 取得借款收到的现金 | 208,634,905.00 | - | 158,204,400.00 | - | ||

| 发行债券收到的现金 | - | - | - | - | ||

| 收到的其他与筹资活动有关的现金 | - | - | - | - | 六、46 | |

| 筹资活动现金流入小计 | 208,634,905.00 | - | 11,073,066,024.32 | 10,914,861,624.32 | ||

| 偿还债务支付的现金 | 4,000,000,000.00 | 4,000,000,000.00 | ||||

| 分配股利、利润或偿付利息支出支付的现金 | 1,911,771,790.16 | 1,903,968,818.99 | 387,256,838.73 | 313,200,880.00 | ||

| 其中:子公司支付给少数股东的股利、利润 | - | - | - | - | ||

| 支付的其他与筹资活动有关的现金 | - | - | 24,104,500.15 | 24,104,500.15 | 六、46 | |

| 筹资活动现金流出小计 | 5,911,771,790.16 | 5,903,968,818.99 | 411,361,338.88 | 337,305,380.15 | ||

| 筹资活动产生的现金流量净额 | -5,703,136,885.16 | -5,903,968,818.99 | 10,661,704,685.44 | 10,577,556,244.17 | ||

| 四、汇率变动对现金及现金等价物的影响 | -160,198,566.30 | -42,333,007.30 | 414,941.85 | 16,865.05 | ||

| 五、现金及现金等价物净增加额 | -6,526,118,372.22 | -8,045,228,896.95 | 34,825,739,119.08 | 34,136,418,096.05 | ||

| 加:期初现金及现金等价物余额 | 69,168,031,486.63 | 65,292,263,834.18 | 34,342,292,367.55 | 31,155,845,738.13 | 六、47 | 二十、12 |

| 六、期末现金及现金等价物余额 | 62,641,913,114.41 | 57,247,034,937.23 | 69,168,031,486.63 | 65,292,263,834.18 | 六、47 | 二十、12 |

法定代表人:宫少林 主管会计工作负责人:邓晓力 会计机构负责人:车晓昕

合并所有者权益变动表

编制单位:招商证券股份有限公司 2010年度 金额单位:元

| 项目 | 本期金额 | 少数股东权益 | 所有者权益合计 | |||||||

| 股本 | 资本公积 | 减:库存股 | 盈余公积 | 一般风险准备 | 交易风险准备 | 未分配利润 | 外币报表折算差异 | |||

| 一、上年年末余额 | 3,585,461,407.00 | 10,576,385,008.34 | - | 1,168,703,839.70 | 1,168,703,839.15 | 1,039,890,833.69 | 5,118,947,884.40 | -51,935,381.64 | 9,579,540.32 | 22,615,736,970.96 |

| 加:会计政策变更 | - | - | - | - | - | - | - | - | - | - |

| 前期差错更正 | - | - | - | - | - | - | - | - | - | - |

| 其他 | - | - | - | - | - | - | - | - | - | - |

| 二、本年年初余额 | 3,585,461,407.00 | 10,576,385,008.34 | - | 1,168,703,839.70 | 1,168,703,839.15 | 1,039,890,833.69 | 5,118,947,884.40 | -51,935,381.64 | 9,579,540.32 | 22,615,736,970.96 |

| 三、本年增减变动金额(减少以“-”号填列) | - | -24,382,694.53 | - | 301,246,858.75 | 301,246,858.75 | 301,246,858.75 | 528,163,569.49 | -37,838,392.08 | -9,579,540.32 | 1,360,103,518.81 |

| (一)净利润 | - | - | - | - | - | - | 3,228,860,702.33 | - | - | 3,228,860,702.33 |

| (二)其他综合收益 | - | -24,382,694.53 | - | - | - | - | - | -37,838,392.08 | - | -62,221,086.61 |

| 上述(一)和(二)小计 | - | -24,382,694.53 | - | - | - | - | 3,228,860,702.33 | -37,838,392.08 | - | 3,166,639,615.72 |

| (三)所有者投入和减少资本 | - | - | - | - | - | - | -4,225,853.09 | - | -9,579,540.32 | -13,805,393.41 |

| 1.所有者投入资本 | - | - | - | - | - | - | - | - | - | - |

| 2.股份支付计入所有者权益的金额 | - | - | - | - | - | - | - | - | - | - |

| 3.其他 | - | - | - | - | - | - | -4,225,853.09 | -9,579,540.32 | -13,805,393.41 | |

| (四)利润分配 | - | - | - | 301,246,858.75 | 301,246,858.75 | 301,246,858.75 | -2,696,471,279.75 | - | - | -1,792,730,703.50 |

| 1.提取盈余公积 | - | - | - | 301,246,858.75 | - | - | -301,246,858.75 | - | - | - |

| 2.提取一般风险准备 | - | - | - | - | 301,246,858.75 | - | -301,246,858.75 | - | - | - |

| 3.提取交易风险准备 | - | - | - | - | - | 301,246,858.75 | -301,246,858.75 | - | - | - |

| 4.对所有者(或股东)的分配 | - | - | - | - | - | - | -1,792,730,703.50 | - | - | -1,792,730,703.50 |

| 5.其他 | - | - | - | - | - | - | - | - | - | - |

| (五)所有者权益内部结转 | - | - | - | - | - | - | - | - | - | - |

| 1.资本公积转增股本 | - | - | - | - | - | - | - | - | - | - |

| 2.盈余公积转增股本 | - | - | - | - | - | - | - | - | - | - |

| 3.盈余公积弥补亏损 | - | - | - | - | - | - | - | - | - | - |

| 4.一般风险准备弥补亏损 | - | - | - | - | - | - | - | - | - | - |

| 5.其他 | - | - | - | - | - | - | - | - | - | - |

| (六)专项储备 | - | - | - | - | - | - | - | - | - | - |

| 1.本期提取 | - | - | - | - | - | - | - | - | - | - |

| 2.本期使用 | - | - | - | - | - | - | - | - | - | - |

| (七)其他 | - | - | - | - | - | - | - | - | - | - |

| 四、本年年末余额 | 3,585,461,407.00 | 10,552,002,313.81 | - | 1,469,950,698.45 | 1,469,950,697.90 | 1,341,137,692.44 | 5,647,111,453.89 | -89,773,773.72 | - | 23,975,840,489.77 |

法定代表人:宫少林 主管会计工作负责人:邓晓力 会计机构负责人:车晓昕

合并所有者权益变动表(续)

编制单位:招商证券股份有限公司 2010年度 金额单位:元

| 项目 | 上期金额 | 少数股东权益 | 所有者权益合计 | |||||||

| 股本 | 资本公积 | 减:库存股 | 盈余公积 | 一般风险准备 | 交易风险准备 | 未分配利润 | 外币报表折算差异 | |||

| 一、上年年末余额 | 3,226,915,266.00 | -41,958,405.66 | - | 786,838,973.83 | 786,838,973.28 | 658,025,967.82 | 2,536,819,678.36 | -51,087,297.09 | 235,401,829.42 | 8,137,794,985.96 |

| 加:会计政策变更 | - | - | - | - | - | - | - | - | - | - |

| 前期差错更正 | - | - | - | - | - | - | - | - | - | - |

| 其他 | - | - | - | 17,625,341.01 | 17,625,341.01 | 17,625,341.01 | -52,876,023.03 | - | - | - |

| 二、本年年初余额 | 3,226,915,266.00 | -41,958,405.66 | - | 804,464,314.84 | 804,464,314.29 | 675,651,308.83 | 2,483,943,655.33 | -51,087,297.09 | 235,401,829.42 | 8,137,794,985.96 |

| 三、本年增减变动金额(减少以“-”号填列) | 358,546,141.00 | 10,618,343,414.00 | - | 364,239,524.86 | 364,239,524.86 | 364,239,524.86 | 2,635,004,229.07 | -848,084.55 | -225,822,289.10 | 18,403,367,595.45 |

| (一)净利润 | - | - | - | - | - | - | 3,727,722,803.65 | - | 197,702,806.80 | 3,925,425,610.45 |

| (二)其他综合收益 | - | 93,528,424.13 | - | - | - | - | - | -848,084.55 | 5,954,431.18 | 98,634,770.76 |

| 上述(一)和(二)小计 | - | 93,528,424.13 | - | - | - | - | 3,727,722,803.65 | -848,084.55 | 203,657,237.98 | 4,024,060,381.21 |

| (三)所有者投入和减少资本 | 358,546,141.00 | 10,524,814,989.87 | - | - | - | - | - | - | -429,479,527.08 | 10,453,881,603.79 |

| 1.所有者投入资本 | 358,546,141.00 | 10,524,814,989.87 | 10,883,361,130.87 | |||||||

| 2.股份支付计入所有者权益的金额 | - | - | - | - | - | - | - | - | - | - |

| 3.其他 | - | - | - | - | - | - | - | - | -429,479,527.08 | -429,479,527.08 |

| (四)利润分配 | - | - | - | 364,239,524.86 | 364,239,524.86 | 364,239,524.86 | -1,092,718,574.58 | - | - | - |

| 1.提取盈余公积 | - | - | - | 364,239,524.86 | - | - | -364,239,524.86 | - | - | - |

| 2.提取一般风险准备 | - | - | - | - | 364,239,524.86 | - | -364,239,524.86 | - | - | - |

| 3.提取交易风险准备 | - | - | - | - | - | 364,239,524.86 | -364,239,524.86 | - | - | - |

| 4.对所有者(或股东)的分配 | - | - | - | - | - | - | - | - | - | - |

| 5.其他 | - | - | - | - | - | - | - | - | - | - |

| (五)所有者权益内部结转 | - | - | - | - | - | - | - | - | - | - |

| 1.资本公积转增股本 | - | - | - | - | - | - | - | - | - | - |

| 2.盈余公积转增股本 | - | - | - | - | - | - | - | - | - | - |

| 3.盈余公积弥补亏损 | - | - | - | - | - | - | - | - | - | - |

| 4.一般风险准备弥补亏损 | - | - | - | - | - | - | - | - | - | - |

| 5.其他 | - | - | - | - | - | - | - | - | - | - |

| (六)专项储备 | - | - | - | - | - | - | - | - | - | - |

| 1.本期提取 | - | - | - | - | - | - | - | - | - | - |

| 2.本期使用 | - | - | - | - | - | - | - | - | - | - |

| (七)其他 | - | - | - | - | - | - | - | - | - | - |

| 四、本年年末余额 | 3,585,461,407.00 | 10,576,385,008.34 | - | 1,168,703,839.70 | 1,168,703,839.15 | 1,039,890,833.69 | 5,118,947,884.40 | -51,935,381.64 | 9,579,540.32 | 22,615,736,970.96 |

法定代表人: 宫少林 主管会计工作负责人:邓晓力 会计机构负责人:车晓昕

母公司所有者权益变动表

编制单位:招商证券股份有限公司 2010年度 金额单位:元

| 项目 | 本期金额 | |||||||

| 股本 | 资本公积 | 减:库存股 | 盈余公积 | 一般风险准备 | 交易风险准备 | 未分配利润 | 所有者权益合计 | |

| 一、上年年末余额 | 3,585,461,407.00 | 10,582,747,737.26 | - | 1,168,703,839.70 | 1,168,703,839.15 | 1,039,890,833.69 | 4,707,012,779.82 | 22,252,520,436.62 |

| 加:会计政策变更 | - | - | - | - | - | - | - | - |

| 前期差错更正 | - | - | - | - | - | - | - | - |

| 其他 | - | - | - | - | - | - | - | - |

| 二、本年年初余额 | 3,585,461,407.00 | 10,582,747,737.26 | - | 1,168,703,839.70 | 1,168,703,839.15 | 1,039,890,833.69 | 4,707,012,779.82 | 22,252,520,436.62 |

| 三、本年增减变动金额(减少以“-”号填列) | - | -29,760,619.34 | - | 301,246,858.75 | 301,246,858.75 | 301,246,858.75 | 315,997,307.73 | 1,189,977,264.64 |

| (一)净利润 | - | - | - | - | - | - | 3,012,468,587.48 | 3,012,468,587.48 |

| (二)其他综合收益 | - | -29,760,619.34 | - | - | - | - | - | -29,760,619.34 |

| 上述(一)和(二)小计 | - | -29,760,619.34 | - | - | - | - | 3,012,468,587.48 | 2,982,707,968.14 |

| (三)所有者投入和减少资本 | - | - | - | - | - | - | - | - |

| 1.所有者投入资本 | - | - | - | - | - | - | - | - |

| 2.股份支付计入所有者权益的金额 | - | - | - | - | - | - | - | - |

| 3.其他 | - | - | - | - | - | - | - | - |

| (四)利润分配 | - | - | - | 301,246,858.75 | 301,246,858.75 | 301,246,858.75 | -2,696,471,279.75 | -1,792,730,703.50 |

| 1.提取盈余公积 | - | - | - | 301,246,858.75 | - | - | -301,246,858.75 | - |

| 2.提取一般风险准备 | - | - | - | - | 301,246,858.75 | - | -301,246,858.75 | - |

| 3.提取交易风险准备 | - | - | - | - | - | 301,246,858.75 | -301,246,858.75 | - |

| 4.对所有者(或股东)的分配 | - | - | - | - | - | - | -1,792,730,703.50 | -1,792,730,703.50 |

| 5.其他 | - | - | - | - | - | - | - | - |

| (五)所有者权益内部结转 | - | - | - | - | - | - | - | - |

| 1.资本公积转增资本 | - | - | - | - | - | - | - | - |

| 2.盈余公积转增资本 | - | - | - | - | - | - | - | - |

| 3.盈余公积弥补亏损 | - | - | - | - | - | - | - | - |

| 4.一般风险准备弥补亏损 | - | - | - | - | - | - | - | - |

| 5.其他 | - | - | - | - | - | - | - | - |

| (六)专项储备 | - | - | - | - | - | - | - | - |

| 1.本期提取 | - | - | - | - | - | - | - | - |

| 2.本期使用 | - | - | - | - | - | - | - | - |

| (七)其他 | - | - | - | - | - | - | - | - |

| 四、本年年末余额 | 3,585,461,407.00 | 10,552,987,117.92 | - | 1,469,950,698.45 | 1,469,950,697.90 | 1,341,137,692.44 | 5,023,010,087.55 | 23,442,497,701.26 |

法定代表人:宫少林 主管会计工作负责人:邓晓力 会计机构负责人:车晓昕

母公司所有者权益变动表(续)

编制单位:招商证券股份有限公司 2010年度 金额单位:元

| 项目 | 上期金额 | |||||||

| 股本 | 资本公积 | 减:库存股 | 盈余公积 | 一般风险准备 | 交易风险准备 | 未分配利润 | 所有者权益合计 | |

| 一、上年年末余额 | 3,226,915,266.00 | -10,311,263.73 | - | 786,838,973.83 | 786,838,973.28 | 658,025,967.82 | 2,033,958,718.69 | 7,482,266,635.89 |

| 加:会计政策变更 | - | - | - | - | - | - | - | - |

| 前期差错更正 | - | - | - | - | - | - | - | - |

| 其他 | - | -18,564,012.30 | 17,625,341.01 | 17,625,341.01 | 17,625,341.01 | 123,377,387.07 | 157,689,397.80 | |

| 二、本年年初余额 | 3,226,915,266.00 | -28,875,276.03 | - | 804,464,314.84 | 804,464,314.29 | 675,651,308.83 | 2,157,336,105.76 | 7,639,956,033.69 |

| 三、本年增减变动金额(减少以“-”号填列) | 358,546,141.00 | 10,611,623,013.29 | - | 364,239,524.86 | 364,239,524.86 | 364,239,524.86 | 2,549,676,674.06 | 14,612,564,402.93 |

| (一)净利润 | - | - | - | - | - | - | 3,642,395,248.64 | 3,642,395,248.64 |

| (二)其他综合收益 | - | 86,808,023.42 | - | - | - | - | - | 86,808,023.42 |

| 上述(一)和(二)小计 | - | 86,808,023.42 | - | - | - | - | 3,642,395,248.64 | 3,729,203,272.06 |

| (三)所有者投入和减少资本 | 358,546,141.00 | 10,524,814,989.87 | - | - | - | - | - | 10,883,361,130.87 |

| 1.所有者投入资本 | 358,546,141.00 | 10,524,814,989.87 | - | - | - | - | - | 10,883,361,130.87 |

| 2.股份支付计入所有者权益的金额 | - | - | - | - | - | - | - | - |

| 3.其他 | - | - | - | - | - | - | - | - |

| (四)利润分配 | - | - | - | 364,239,524.86 | 364,239,524.86 | 364,239,524.86 | -1,092,718,574.58 | - |

| 1.提取盈余公积 | - | - | - | 364,239,524.86 | - | - | -364,239,524.86 | - |

| 2.提取一般风险准备 | - | - | - | - | 364,239,524.86 | - | -364,239,524.86 | - |

| 3.提取交易风险准备 | - | - | - | - | - | 364,239,524.86 | -364,239,524.86 | - |

| 4.对所有者(或股东)的分配 | - | - | - | - | - | - | - | - |

| 5.其他 | - | - | - | - | - | - | - | - |

| (五)所有者权益内部结转 | - | - | - | - | - | - | - | - |

| 1.资本公积转增资本 | - | - | - | - | - | - | - | - |

| 2.盈余公积转增资本 | - | - | - | - | - | - | - | - |

| 3.盈余公积弥补亏损 | - | - | - | - | - | - | - | - |

| 4.一般风险准备弥补亏损 | - | - | - | - | - | - | - | - |

| 5.其他 | - | - | - | - | - | - | - | - |

| (六)专项储备 | - | - | - | - | - | - | - | - |

| 1.本期提取 | - | - | - | - | - | - | - | - |

| 2.本期使用 | - | - | - | - | - | - | - | - |

| (七)其他 | - | - | - | - | - | - | - | - |

| 四、本年年末余额 | 3,585,461,407.00 | 10,582,747,737.26 | - | 1,168,703,839.70 | 1,168,703,839.15 | 1,039,890,833.69 | 4,707,012,779.82 | 22,252,520,436.62 |

法定代表人:宫少林 主管会计工作负责人:邓晓力 会计机构负责人:车晓昕