|

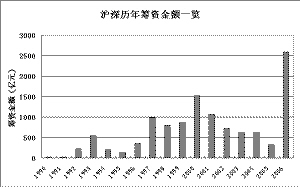

50家券商已于近期披露2006年财务报告,48家盈利,2家亏损,总计盈利180.5亿元。

虽然券商去年业绩暴涨,打了个翻身仗,但是盈利模式并无根本改变。传统业务仍是支柱。整体来看,50家券商营业收入中,手续费收入占比过半,但细分来看,创新类、规范类、其他类券商这一比例分别为86.4%、57.3%、48.6%,创新类券商在业务上显示了更强的灵活性和多样化的能力。比照规范类券商,创新类、其他类券商在收入上更倚重自营,17家创新类券商自营证券差价收入在营业收入中所占比重为27.6%,西部证券、长江证券、东方证券等均有较高自营比例;其他类券商中,红塔证券的自营比例高达81.7%。50家券商整体证券承销收入占营业收入比例为10.2%。

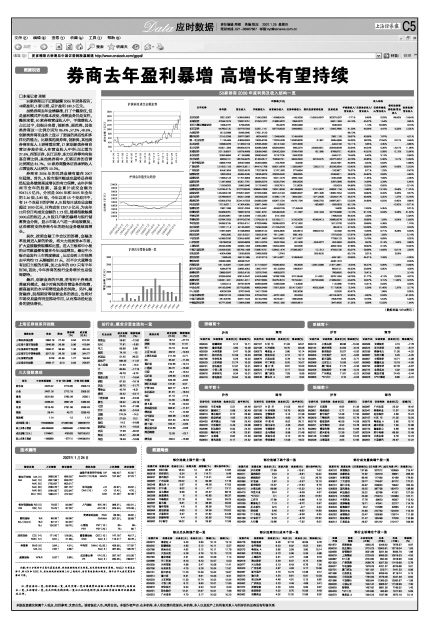

券商在2006年的优异业绩有望在2007年延续。首先,A股市场巨额成交量将是券商经纪业务继续高速增长的有力保障。去年沪深两市全年的股票、基金累计成交金额为92471.5亿元,分别是2004年和2005年全年的2.16倍、2.85倍。今年以来15个交易日中,有14个交易日的沪深A、B股每日成交总金额超过1000亿元,日均成交1257.0亿元,为去年12月份日均成交金额的1.73倍。随着指数触摸3000点的临近,A、B股开户数的暴增与银行储蓄资金分流,显示市场人气进一步地被激发,这些都将支持券商今年的经纪业务继续高增长。

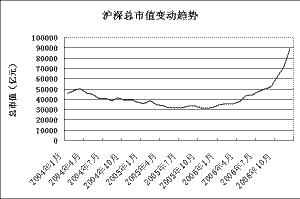

其次,按照金融工作会议的部署,金融改革发展进入新的阶段,将大力发展资本市场,扩大直接融资规模和比重。进入主板和中小板的公司数量都有望在今年迅速增加。最近中小板企业发行上市再度提速 ,从过会到上市挂牌由平均约72天缩减到37天,而不少大蓝筹也有回归主板的打算,加之去年的IPO只有半年时间,因此,今年券商的投行业务增长也是值得期待。

最后,创新业务的开展,将有利于券商改善盈利模式,减少对高风险自营业务的依赖,提高盈利的水平和降低业务的风险。另外,融资融券、股指期货等创新业务的推出,也将对市场交易量有明显推动作用,从而推动经纪业务的更快增长。

50家券商2006年度利润及收入结构一览

公司名称 利润表(万元) 收入结构

净利润 营业收入 手续费收入 自营差价收入 证券承销收入 委托投资管理收益 投资收益 手续费收入/营业收入 自营差价收入/营业收入 证券承销收入/营业收入 委托投资管理收益/营业收入 投资收益/营业收入

北京证券 2001.6367 -153656.9953 11843.0362 -14588.5505 -43.2028 -153552.4647 30027.5327 -7.71% 9.49% 0.03% 99.93% -19.54%

长城证券 27594.7572 70267.2751 31050.1977 31880.3470 1084.2370 6991.1962 44.19% 45.37% 1.54% 9.95%

长江巴黎百富勤证券 1608.2737 5736.0505 65.4979 3595.5989 558.5302 1.14% 62.68% 9.74%

长江证券 44780.5125 126776.7582 52351.1161 58773.0093 5666.8855 421.1276 15662.7880 41.29% 46.36% 4.47% 0.33% 12.35%

大通证券 3513.5688 19349.2845 17051.9120 88.13%

德邦证券 10153.2038 26977.0887 8004.4630 11048.5906 2149.6428 1082.1192 29.67% 40.96% 7.97% 4.01%

第一创业证券 11135.469 43839.3662 10635.8744 17002.5228 12080.8000 6.1861 2845.6869 24.26% 38.78% 27.56% 0.01% 6.49%

东北证券 12098.5978 51360.5159 37035.3630 3413.1540 1207.3000 -442.9130 72.11% 6.65% 2.35% -0.86%

东方证券 93351.1994 186364.6373 62686.2908 83004.6646 668.2270 23493.6921 20644.8068 33.64% 44.54% 0.36% 12.61% 11.08%

东海证券 20119.8557 55078.4668 23599.3492 23420.2359 2799.4789 65.1985 8789.8721 42.85% 42.52% 5.08% 0.12% 15.96%

东吴证券 16392.8894 41139.3886 30683.5560 2219.7735 1284.2000 -344.9121 74.58% 5.40% 3.12% -0.84%

光大证券 89658.161 185724.9475 81303.0517 75859.5751 9843.2920 2810.5575 23377.2557 43.78% 40.85% 5.30% 1.51% 12.59%

广发华福证券 13806.7763 30567.2683 25359.0993 -164.7606 8.4000 4242.7381 82.96% -0.54% 0.03% 13.88%

广发证券 121650.1163 286415.8511 144414.1708 82831.4978 11392.8497 1325.2115 35036.2824 50.42% 28.92% 3.98% 0.46% 12.23%

广州证券 4558.1804 22622.4576 17027.8578 2197.1692 277.8464 -106.3871 75.27% 9.71% 1.23% -0.47%

国都证券 18003.004 46483.4345 18095.9979 20832.6592 389.8395 2249.8611 38.93% 44.82% 0.84% 4.84%

国海证券 11896.4123 51757.4864 35257.3552 6031.1079 3669.1046 -1035.4586 68.12% 11.65% 7.09% -2.00%

国联证券 11347.4693 42351.7781 28290.5074 6220.2764 990.0000 2287.5866 66.80% 14.69% 2.34% 5.40%

国盛证券 11633.8003 15993.3940 15176.4500 -1923.7915 131.8005 -22.5053 94.89% -12.03% 0.82% -0.14%

国泰君安证券 150745.3175 372773.6526 208942.7808 74041.3069 49148.8893 2161.6457 43804.1156 56.05% 19.86% 13.18% 0.58% 11.75%

国信证券 145246.9106 275057.4587 147326.3384 82013.3146 22890.9007 987.1496 18065.7552 53.56% 29.82% 8.32% 0.36% 6.57%

国元证券 55786.6407 84251.5648 30558.5226 41690.1179 1894.4261 1071.0630 13294.9176 36.27% 49.48% 2.25% 1.27% 15.78%

海通证券 65006.3703 253416.7559 134380.3296 63067.1534 16479.1794 1008.5750 24987.3071 53.03% 24.89% 6.50% 0.40% 9.86%

河北证券 17216.6011 41364.4355 33971.0445 -0.2550 -80.9987 -293.0823 82.13% -0.20% -0.71%

恒泰证券 7487.1288 32031.0024 20615.4421 4246.0729 1714.6528 1.8400 64.36% 13.26% 5.35% 0.01%

红塔证券 64368.9781 78967.9724 10341.8731 64549.6226 31.1687 222.1594 32773.8986 13.10% 81.74% 0.04% 0.28% 41.50%

华林证券 -25334.6961 13813.9394 11925.0351 316.1458 1788.0593 86.33% 2.29% 12.94%

华泰证券 80784.7502 197970.0726 110756.5518 53183.5111 3150.5000 4036.6413 26885.6078 55.95% 26.86% 1.59% 2.04% 13.58%

华西证券 34286.3165 87652.4151 47000.4985 26285.8323 4716.1962 1521.0726 53.62% 29.99% 5.38% 1.74%

金元证券 11037.1114 42135.2837 15692.5049 21103.4723 12.5000 98.2416 37.24% 50.09% 0.03% 0.23%

民生证券 17467.3487 31648.8603 20496.3122 4304.3925 225.8619 2682.9152 12.5282 64.76% 13.60% 0.71% 8.48% 0.04%

南京证券 9432.835 33219.2221 19255.8195 7911.2441 608.1425 1707.5092 57.97% 23.82% 1.83% 5.14%

平安证券 55386.0336 123555.8600 34871.9860 19497.9820 11971.0467 7728.8122 28.22% 15.78% 9.69% 6.26%

山西证券 13578.6034 29345.8829 20512.3374 2503.7656 42.1900 -304.2077 262.3962 69.90% 8.53% 0.14% -1.04% 0.89%

上海证券 26243.3399 49464.1458 23684.0885 18264.3306 92.5600 4958.7434 47.88% 36.92% 0.19% 10.02%

申银万国证券 122406.4025 185766.1408 172887.4731 -53842.1476 27286.2857 15.1312 4793.6100 93.07% -28.98% 14.69% 0.01% 2.58%

世纪证券 -4304.4089 12592.8293 10466.9208 1.3742 263.4532 83.12% 0.01% 2.09%

首创证券 12905.83 29610.1985 9167.6716 13415.2871 2198.8550 -593.1851 30.96% 45.31% 7.43% -2.00%

泰阳证券 23845.5805 49048.7547 4436.1374 9.04%

西部证券 56110.3307 112291.0267 21716.9227 73289.4062 69.3000 12381.0089 21871.3861 19.34% 65.27% 0.06% 11.03% 19.48%

新时代证券 4284.9779 20845.4052 13827.7077 4312.9349 198.8547 892.8131 66.33% 20.69% 0.95% 4.28%

信泰证券 10886.6597 25052.4165 16276.7642 4863.6370 786.8950 64.97% 19.41% 3.14%

兴业证券 30336.6934 90914.2547 53435.5888 19788.7268 3741.8548 51.4351 3976.1694 58.78% 21.77% 4.12% 0.06% 4.37%

招商证券 104081.1931 224651.4311 97507.6695 65975.3574 7072.0441 26732.9289 21989.0341 43.40% 29.37% 3.15% 11.90% 9.79%

浙商证券 12250.212 39747.9478 30863.9298 5290.6399 14.3000 112.5985 77.65% 13.31% 0.04% 0.28%

中金公司 84192.6646 327723.9385 49936.6499 17657.3559 201417.2657 4502.3399 7117.9095 15.24% 5.39% 61.46% 1.37% 2.17%

中山证券 4000.0209 16707.6443 15617.0249 330.3008 0.0230 93.47% 1.98% 0.00%

中信金通证券 36857.8102 50649.7024 47029.7623 -4370.1830 20.9250 -46104.2972 92.85% -8.63% 0.04% -91.03%

中信万通证券 10519.6705 30371.7223 20133.7093 3273.4311 1680.0000 1658.3760 66.29% 10.78% 5.53% 5.46%

中银国际证券 42777.3599 112864.6388 35040.4843 9462.1382 16959.9816 1847.4605 31.05% 8.38% 15.03% 1.64%

(数据来源:Wind资讯)