|

“广场协议”前后:日元升值与资产价格如何互动

主持人:近日来,人民币正在以更大的波动幅度运行在升值的轨道中。对人民币升值问题,国内外经济界有许多不同看法。是利是弊,投资界始终在密切关注;是祸是福,老百姓也非常关心。特别是有不少研究人士,常常拿日本的教训做比较。

其实,中国现在的情况与当年的日本有很大不同。可比性不一定很强。但是了解日本当年本币升值与资产价格上涨的关系,以日本的经验为警戒采取适当措施抑制资产价格膨胀,避免经济后患,也是一个很有意思的话题。你能否介绍一下当年日元升值与资产价格上涨的情况?

伞锋:是的,相对而言,日本的经验教训可能会给我们更多启发。这么说吧,从二战后到上世纪80年代前半期,日本的股票市场并不活跃。从1976年初至1985年底十年间,日经225指数从4684点上升到13083点,年均涨幅为10.8%。

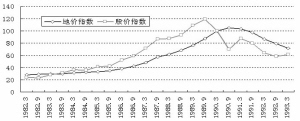

然而,从上世纪80年代后半期开始,以股价和地价为代表的日本资产价格经历了从迅速上升到破灭的过程(见图1)。日经225指数从1985年底的13000点上升到1989年底的39000点,在1989年12月底曾达到创纪录的39815点。

在1985年到1990年期间,日本地价年均上涨13%,大城市地价上涨快于中小城市,商业地价上涨快于住宅用地和工业用地价格。在紧缩货币政策的影响下,从1990年2月份开始,日经225指数从39000点开始下跌,2003年4月底曾跌至7831点。日本地价也从1990年中期开始停止上升,截至1993年底,日本六大城市地价比1990年高点下跌了36%,1999年比1990年9月低了80%。日本地价在2002年仍继续下跌。

尽管影响日本资产价格从膨胀到破灭的过程中有多种原因,但日元大幅升值,以及升值后日本政府的应对失误却是最重要的影响因素。

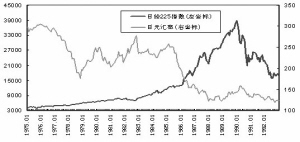

日元升值早在1971年就开始了,它经历了一个曲折的过程。然而,1985年以前的日元升值并未带来资产价格膨胀(见图2)。从1960年代末开始,日本经常项目出现巨额顺差,证明日元汇率被严重低估了,但日本政府为维持固定汇率,采取多种措施放松对资本外流的限制,并促进商品和劳务进口,可是仍无法抵御美国政府要求日元升值的压力。受“尼克松冲击”(1971年)的影响,日元汇率升到1美元兑换340日元,并开始实行浮动汇率制。当年12月18日,“史密森协议”后,日元再次升值16.88%,达到1美元兑308日元,浮动上下限也从过去的0.75%变更为2.25%。1973年2月,大藏省宣布取消对外汇汇率浮动幅度限制,此后日元对美元汇率的波动范围在1美元兑306日元至195日元之间,但总体上处于升值趋势。

然而,1985年9月的“广场协议”破坏了市场决定的汇率关系,美日德法英五国联合干预外汇市场,日本政府出售美元买入日元,导致日元大幅度升值。到1987年底日元对美元汇率升至1美元兑120日元。在日元大幅度升值的1986年,日本工业出现了负增长,经济增长率也处于仅次于1974年第一次石油危机后的低水平。

为了摆脱日元升值可能导致的经济衰退,1987年5月,日本政府决定减税1万亿日元和追加5万亿日元的公共事业投资,7月又补增2万亿日元的财政开支。当年日本银行分4次将官定利率降至2.5%,成为战后以来的最低水平。

引起日本银行降低利率的另一个原因是,1987年10月19日美国“黑色星期一”引发了全球股灾。作为政策协调的结果,各国银行纷纷降低利率。“双扩张”政策的实施,加之石油价格从高位下跌,使经济出现了稳定增长的局面,日本经济从“高日元萧条”中解脱出来。

特别关注:曾经有四大因素影响日本资产价格暴涨

主持人:显然,日元升值对日本资产价格上涨的影响是非常突出的。那么,反过来,日元升值又是如何影响日本资产价格从膨胀到泡沫破灭的过程的?这对中国抑制资产价格膨胀又有什么样的启示?

伞锋:在“广场协议”前后两个不同时期,日元升值对资产价格的影响有着天壤之别。那么,这两者间的作用机制是如何的呢?

虽然影响资产价格的因素很多,但从理论上看,主要有四个基本影响因素:一是经济基本面,即经济增长及其影响下的资产收益;二是资金的供给状况,宽松的流动性有助于资产价格上涨;三是物价水平,较低的物价水平意味着较低的政策性利率;四是投资者信心,并非都是理性的投资者信心高涨增强了其风险承担能力。所以,政策性利率越高和风险承担能力越弱,资产价格越低;资产收益越高资产价格就越高。反之亦然。

从日元升值的两个不同时期看,1971至1985年日元升值期间,这四个条件只是部分地得到了满足,资产价格并未出现大幅度上涨。但自1985年以后,这四个条件均得到满足,加之其他因素的影响,资产价格出现了大幅度上涨,并产生了资产泡沫。

自1971年后,为防止日元升值导致的经济衰退,日本政府实施了扩张性的货币政策,货币流动性异常宽松,1973年货币供应量增幅曾达20%,通货膨胀率明显上升。加之受高油价的影响,日本政府不得不提高政策性利率,从而抑制了资产价格上涨,而1974年的经济负增长和日元的贬值压力又抑制了投资者信心,也抑制了资产价格上涨。

例如,早在1972年,田中首相《日本列岛改造论》出版后,日本岛内就掀起了第一轮地价上涨,但高利率使房地产的上涨受到抑制。例如,1973年初,由于通货膨胀率迅速上升,日本银行被迫将官定利率提高至6%,此后,高利率在较长时期保持,也极大地限制了土地价格的上涨势头。

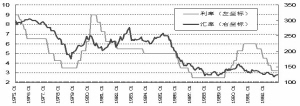

1985年“广场协议”后,扩张性货币政策带来大量流动性,而日元大幅度升值产生的紧缩效应,使通货膨胀率处于较低水平,使低利率能维持较长时间,加剧了流动性过剩(见图3、表1)。

从本币升值带动资产价格上涨的四个条件看:第一,经济增长率比泡沫经济生成前明显上升。1986-1990年间年均经济增长4.9%,比1981-1985年高出1.6个百分点,年均劳动生产率提高1.1个百分点,非住宅投资占GDP的比重提高2.2个百分点。

第二,货币流动性较为宽松,长期实际利率水平明显下降。1986-1990年广义货币增长率由1981-1985年的8.3%增加到10.4%,增长了2.1个百分点。长期实际利率由1981-1985年的4.8%降至1986-1990年的4.2%。

第三,消费者物价保持较低水平。1986-1990年间消费者价格年均增长率由1981-1985年的2.8%降至1.3%,从而使政策性利率也保持较低的水平。从1987到1989年5月,日本官定利率一直保持在2.5%的低水平。2002年美联储的一项研究表明,从事后看,日本政府如果在1989年以前及时紧缩货币政策,不至于后来出现严重的资产泡沫。

第四,国民自信心膨胀。与70年代的两次石油危机相比,80年代后半期外部冲击较少,而资产泡沫形成初期日本经济良好的表现,使投资者产生了乐观的情绪。80年代后半期,“高投资、高增长、低通胀”的日本经济一派繁荣,加之以美元计价的国民财富大量增加,使投资者信心也随之高涨。大量的企业和个人在“从众行为”的驱使下,纷纷入市,争相购置房产地契。日本总理府1987年的调查显示,超过半数以上的受访者认为“只有土地是安心并且有利的”。

此外,导致1985年后日本资产价格膨胀还有特殊的原因。一是当时正值金融自由化之后,放松管制推动了资产市场发展;二是日本经济已高度发达,大量过剩资本要寻找出路。第一次石油危机后,日本产业结构开始由以重化工业为主向以技术密集型产业为主转型,制造业贷款需求减弱,大量过剩资金涌向房地产业。

在1980年代后半期资产价格膨胀过程中,日本出现了股价与地价共同上升、相互促进的局面。在日元大幅度升值后,股价的上涨和充足的货币供给促使企业将过剩资金投入到土地市场,又导致地价上涨。以土地为担保品的价值随着土地价格的上涨而上涨,外部融资溢价下降使企业可以大量借款,这进一步刺激了股价上涨。同时,在金融自由化的促进下,企业可以从资本市场上筹集大量低利资金,将其用于设备投资、股票和房地产投机,又以剩余的资金提前偿还银行贷款,结果造成大银行资金严重过剩,只能向房地产融资寻求新的出路。不管是谁,只要有土地作担保,大银行都提供贷款。

日本股市泡沫产生和破灭前后主要经济指标的变化

资产泡沫 资产泡沫 资产泡沫

形成前 膨胀时期 破灭后

(1981-85) (1986-90) (1991-95)

GDP年均增长率(%) 3.3 4.9 1.4

劳动生产率年均增长率(%) 2.3 3.4 0.8

消费者价格年均增长率(%) 2.8 1.3 1.4

非住宅投资占GDP的比重(%) 15.7 17.9 16.7

长期实际利率平均水平(%)1 4.8 4.2 3.6

广义货币年均增长率(%) 8.3 10.4 2.1

期末股票市盈率(倍数) 35.2 69.52 86.5

股票价格涨幅(期间指数,1980=100) 211 5632 314

住宅价格涨幅(期间指数,1980=100) 131 190 172

名义有效汇率涨幅(期间指数,1980=100) 129 154 208

进口占GDP比重(%) 12.5 8.1 7.5

净私人储蓄占GDP比重(%) 4.7 1.6 3.7

预算收支占GDP比重(%) -2.8 1.3 -1.1

经常账户差额占GDP比重(%) 1.8 2.8 2.6

净资本流入占GDP比重(%)3 -1.3 -3.6 -0.9

居民储蓄占可支配收入比重(%) 22.0 17.6 14.0

期末居民部门债务占GDP比重(%) 47 61 63

期末企业债务占GDP比重(%) 99 131 132

注:1.十年期政府债券名义利率减去年度通货膨胀率(消费者支出平减指数);2.最后一年的峰值;3.直接投资和证券投资的净值。

资料来源:BIS, “71st Annual Repost”, p29. http://www.bis.org.