福建福日电子股份有限公司2007年度报告摘要福建福日电子股份有限公司2007年度报告摘要

2008年04月29日 来源:上海证券报 作者:

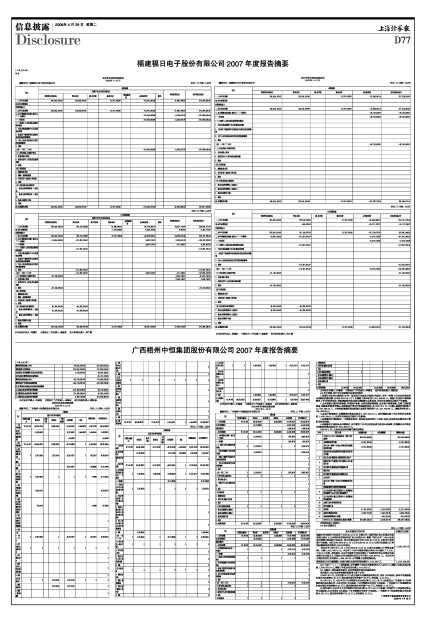

福建福日电子股份有限公司2007年度报告摘要

(上接D74版)

附表

合并所有者权益变动表

2007年1-12月

编制单位: 福建福日电子股份有限公司 单位: 元 币种:人民币

母公司所有者权益变动表

2007年1-12月

编制单位: 福建福日电子股份有限公司 单位: 元 币种:人民币

| 项目 | 本期金额 |

| 归属于母公司所有者权益 | 少数股东权益 | 所有者权益合计 |

| 实收资本(或股本) | 资本公积 | 减:库存股 | 盈余公积 | 一般风险准备 | 未分配利润 | 其他 |

| 一、上年年末余额 | 240,544,100.00 | 134,363,991.08 | 13,767,009.58 | -55,941,994.36 | 37,660,479.80 | 370,393,586.10 |

| 加:会计政策变更 | ||||||

| 前期差错更正 | ||||||

| 二、本年年初余额 | 240,544,100.00 | 134,363,991.08 | 13,767,009.58 | -55,941,994.36 | 37,660,479.80 | 370,393,586.10 |

| 三、本年增减变动金额(减少以“-”号填列) | -118,500,683.69 | -4,065,876.75 | -122,566,560.44 | |||

| (一)净利润 | -118,500,683.69 | -4,065,876.75 | -122,566,560.44 | |||

| (二)直接计入所有者权益的利得和损失 | ||||||

| 1.可供出售金融资产公允价值变动净额 | ||||||

| 2.权益法下被投资单位其他所有者权益变动的影响 | ||||||

| 3.与计入所有者权益项目相关的所得税影响 | ||||||

| 4.其他 | ||||||

| 上述(一)和(二)小计 | -118,500,683.69 | -4,065,876.75 | -122,566,560.44 | |||

| (三)所有者投入和减少资本 | ||||||

| 1.所有者投入资本 | ||||||

| 2.股份支付计入所有者权益的金额 | ||||||

| 3.其他 | ||||||

| (四)利润分配 | ||||||

| 1.提取盈余公积 | ||||||

| 2.提取一般风险准备 | ||||||

| 3.对所有者(或股东)的分配 | ||||||

| 4.其他 | ||||||

| (五)所有者权益内部结转 | ||||||

| 1.资本公积转增资本(或股本) | ||||||

| 2.盈余公积转增资本(或股本) | ||||||

| 3.盈余公积弥补亏损 | ||||||

| 4.其他 | ||||||

| 四、本期期末余额 | 240,544,100.00 | 134,363,991.08 | 13,767,009.58 | -174,442,678.05 | 33,594,603.05 | 247,827,025.66 |

| 项目 | 本期金额 |

| 实收资本(或股本) | 资本公积 | 减:库存股 | 盈余公积 | 未分配利润 | 所有者权益合计 |

| 一、上年年末余额 | 240,544,100.00 | 133,541,691.58 | 13,767,009.58 | -70,648,547.14 | 317,204,254.02 |

| 加:会计政策变更 | |||||

| 前期差错更正 | |||||

| 二、本年年初余额 | 240,544,100.00 | 133,541,691.58 | 13,767,009.58 | -70,648,547.14 | 317,204,254.02 |

| 三、本年增减变动金额(减少以“-”号填列) | -96,743,582.61 | -96,743,582.61 | |||

| (一)净利润 | -96,743,582.61 | -96,743,582.61 | |||

| (二)直接计入所有者权益的利得和损失 | |||||

| 1.可供出售金融资产公允价值变动净额 | |||||

| 2.权益法下被投资单位其他所有者权益变动的影响 | |||||

| 3.与计入所有者权益项目相关的所得税影响 | |||||

| 4.其他 | |||||

| 上述(一)和(二)小计 | -96,743,582.61 | -96,743,582.61 | |||

| (三)所有者投入和减少资本 | |||||

| 1.所有者投入资本 | |||||

| 2.股份支付计入所有者权益的金额 | |||||

| 3.其他 | |||||

| (四)利润分配 | |||||

| 1.提取盈余公积 | |||||

| 2.对所有者(或股东)的分配 | |||||

| 3.其他 | |||||

| (五)所有者权益内部结转 | |||||

| 1.资本公积转增资本(或股本) | |||||

| 2.盈余公积转增资本(或股本) | |||||

| 3.盈余公积弥补亏损 | |||||

| 4.其他 | |||||

| 四、本期期末余额 | 240,544,100.00 | 133,541,691.58 | 13,767,009.58 | -167,392,129.75 | 220,460,671.41 |

单位:元 币种:人民币

| 项目 | 上年同期金额 |

| 归属于母公司所有者权益 | 少数股东权益 | 所有者权益合计 |

| 实收资本(或股本) | 资本公积 | 减:库存股 | 盈余公积 | 一般风险准备 | 未分配利润 | 其他 |

| 一、上年年末余额 | 256,400,000.00 | 292,015,606.55 | 20,845,844.13 | -65,278,859.78 | 34,557,110.89 | 538,539,701.79 |

| 加:会计政策变更 | -7,078,834.55 | 4,649,190.64 | 9,867.55 | -2,419,776.37 | ||

| 前期差错更正 | ||||||

| 二、本年年初余额 | 256,400,000.00 | 292,015,606.55 | 13,767,009.58 | -60,629,669.14 | 34,566,978.44 | 536,119,925.42 |

| 三、本年增减变动金额(减少以“-”号填列) | -15,855,900.00 | -157,651,615.47 | 4,687,674.79 | 3,093,501.36 | -165,726,339.32 | |

| (一)净利润 | 4,687,674.79 | -211,248.61 | 4,476,426.18 | |||

| (二)直接计入所有者权益的利得和损失 | -112,361,615.47 | -112,361,615.47 | ||||

| 1.可供出售金融资产公允价值变动净额 | ||||||

| 2.权益法下被投资单位其他所有者权益变动的影响 | ||||||

| 3.与计入所有者权益项目相关的所得税影响 | ||||||

| 4.其他 | -112,361,615.47 | -112,361,615.47 | ||||

| 上述(一)和(二)小计 | -112,361,615.47 | 4,687,674.79 | -211,248.61 | -107,885,189.29 | ||

| (三)所有者投入和减少资本 | -61,145,900.00 | 3,304,749.97 | -57,841,150.03 | |||

| 1.所有者投入资本 | 3,304,749.97 | 3,304,749.97 | ||||

| 2.股份支付计入所有者权益的金额 | ||||||

| 3.其他 | -61,145,900.00 | -61,145,900.00 | ||||

| (四)利润分配 | ||||||

| 1.提取盈余公积 | ||||||

| 2.提取一般风险准备 | ||||||

| 3.对所有者(或股东)的分配 | ||||||

| 4.其他 | ||||||

| (五)所有者权益内部结转 | 45,290,000.00 | -45,290,000.00 | ||||

| 1.资本公积转增资本(或股本) | 45,290,000.00 | -45,290,000.00 | ||||

| 2.盈余公积转增资本(或股本) | ||||||

| 3.盈余公积弥补亏损 | ||||||

| 4.其他 | ||||||

| 四、本期期末余额 | 240,544,100.00 | 134,363,991.08 | 13,767,009.58 | -55,941,994.36 | 37,660,479.80 | 370,393,586.10 |

福建福日电子股份有限公司2007年度报告摘要

单位:元 币种:人民币

| 项目 | 上年同期金额 |

| 实收资本(或股本) | 资本公积 | 减:库存股 | 盈余公积 | 未分配利润 | 所有者权益合计 |

| 一、上年年末余额 | 256,400,000.00 | 292,034,268.05 | 13,767,009.58 | -58,453,498.79 | 503,747,778.84 |

| 加:会计政策变更 | -840,961.00 | -24,271,173.21 | -25,112,134.21 | ||

| 前期差错更正 | |||||

| 二、本年年初余额 | 256,400,000.00 | 291,193,307.05 | 13,767,009.58 | -82,724,672.00 | 478,635,644.63 |

| 三、本年增减变动金额(减少以“-”号填列) | -15,855,900.00 | -157,651,615.47 | 12,076,124.86 | -161,431,390.61 | |

| (一)净利润 | 12,076,124.86 | 12,076,124.86 | |||

| (二)直接计入所有者权益的利得和损失 | -112,361,615.47 | -112,361,615.47 | |||

| 1.可供出售金融资产公允价值变动净额 | |||||

| 2.权益法下被投资单位其他所有者权益变动的影响 | |||||

| 3.与计入所有者权益项目相关的所得税影响 | |||||

| 4.其他 | -112,361,615.47 | -112,361,615.47 | |||

| 上述(一)和(二)小计 | -112,361,615.47 | 12,076,124.86 | -100,285,490.61 | ||

| (三)所有者投入和减少资本 | -61,145,900.00 | -61,145,900.00 | |||

| 1.所有者投入资本 | |||||

| 2.股份支付计入所有者权益的金额 | |||||

| 3.其他 | -61,145,900.00 | -61,145,900.00 | |||

| (四)利润分配 | |||||

| 1.提取盈余公积 | |||||

| 2.对所有者(或股东)的分配 | |||||

| 3.其他 | |||||

| (五)所有者权益内部结转 | 45,290,000.00 | -45,290,000.00 | |||

| 1.资本公积转增资本(或股本) | 45,290,000.00 | -45,290,000.00 | |||

| 2.盈余公积转增资本(或股本) | |||||

| 3.盈余公积弥补亏损 | |||||

| 4.其他 | |||||

| 四、本期期末余额 | 240,544,100.00 | 133,541,691.58 | 13,767,009.58 | -70,648,547.14 | 317,204,254.02 |

公司法定代表人:刘捷明 主管会计工作负责人:陈富贵 会计机构负责人:郑仁敏

公司法定代表人:刘捷明 主管会计工作负责人:陈富贵 会计机构负责人:郑仁敏