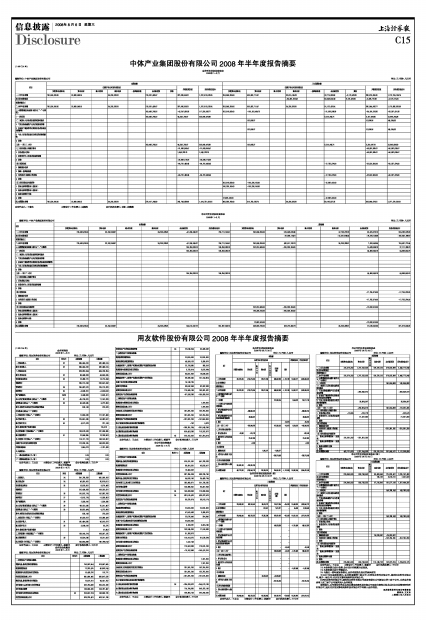

中体产业集团股份有限公司2008年半年度报告摘要

2008年08月06日 来源:上海证券报 作者:

(上接C14版)

合并所有者权益变动表

2008年1-6月

编制单位:中体产业集团股份有限公司 单位:元 币种:人民币

| 项目 | 本期金额 | 上年同期金额 |

| 归属于母公司所有者权益 | 少数股东权益 | 所有者权益合计 | 归属于母公司所有者权益 | 少数股东权益 | 所有者权益合计 |

| 实收资本(或股本) | 资本公积 | 减:库存股 | 盈余公积 | 一般风险准备 | 未分配利润 | 其他 | 实收资本(或股本) | 资本公积 | 减:库存股 | 盈余公积 | 一般风险准备 | 未分配利润 | 其他 |

| 一、上年年末余额 | 730,506,816.00 | 33,869,846.15 | 34,208,326.81 | 210,931,490.07 | 287,996,550.21 | 1,297,513,029.24 | 253,648,200.00 | 500,862,711.47 | 99,010,145.23 | 32,775,933.08 | -9,173,429.20 | 296,670,634.16 | 1,173,794,194.74 |

| 加:会计政策变更 | -64,801,818.42 | 58,346,542.46 | 9,173,429.20 | -5,825,727.39 | -3,107,574.15 | ||||||||

| 前期差错更正 | |||||||||||||

| 二、本年年初余额 | 730,506,816.00 | 33,869,846.15 | 34,208,326.81 | 210,931,490.07 | 287,996,550.21 | 1,297,513,029.24 | 253,648,200.00 | 500,862,711.47 | 34,208,326.81 | 91,122,475.54 | 290,844,906.77 | 1,170,686,620.59 | |

| 三、本期增减变动金额(减少以“-”号填列) | 159,485,756.02 | -42,247,693.25 | 117,238,062.77 | 202,918,560.00 | -190,103,484.73 | -21,926,938.29 | -84,195,228.26 | -93,307,091.28 | |||||

| (一)净利润 | 159,485,756.02 | 44,503,720.67 | 203,989,476.69 | 8,510,845.71 | 5,187,398.55 | 13,698,244.26 | |||||||

| (二)直接计入所有者权益的利得和损失 | 132,665.27 | 12,699.06 | 145,364.33 | ||||||||||

| 1.可供出售金融资产公允价值变动净额 | |||||||||||||

| 2.权益法下被投资单位其他所有者权益变动的影响 | 132,665.27 | 12,699.06 | 145,364.33 | ||||||||||

| 3.与计入所有者权益项目相关的所得税影响 | |||||||||||||

| 4.其他 | |||||||||||||

| 上述(一)和(二)小计 | 159,485,756.02 | 44,503,720.67 | 203,989,476.69 | 132,665.27 | 8,510,845.71 | 5,200,097.61 | 13,843,608.59 | ||||||

| (三)所有者投入和减少资本 | -21,989,950.47 | -21,989,950.47 | -56,892,825.87 | -56,892,825.87 | |||||||||

| 1.所有者投入资本 | 1,849,223.79 | 1,849,223.79 | -56,892,825.87 | -56,892,825.87 | |||||||||

| 2.股份支付计入所有者权益的金额 | |||||||||||||

| 3.其他 | -23,839,174.26 | -23,839,174.26 | |||||||||||

| (四)利润分配 | -64,761,463.45 | -64,761,463.45 | -17,755,374.00 | -32,502,500.00 | -50,257,874.00 | ||||||||

| 1.提取盈余公积 | |||||||||||||

| 2.提取一般风险准备 | |||||||||||||

| 3.对所有者(或股东)的分配 | -64,761,463.45 | -64,761,463.45 | -17,755,374.00 | -32,502,500.00 | -50,257,874.00 | ||||||||

| 4.其他 | |||||||||||||

| (五)所有者权益内部结转 | 202,918,560.00 | -190,236,150.00 | -12,682,410.00 | ||||||||||

| 1.资本公积转增资本(或股本) | 190,236,150.00 | -190,236,150.00 | |||||||||||

| 2.盈余公积转增资本(或股本) | |||||||||||||

| 3.盈余公积弥补亏损 | |||||||||||||

| 4.其他 | 12,682,410.00 | -12,682,410.00 | |||||||||||

| 四、本期期末余额 | 730,506,816.00 | 33,869,846.15 | 34,208,326.81 | 370,417,246.09 | 245,748,856.96 | 1,414,751,092.01 | 456,566,760.00 | 310,759,226.74 | 34,208,326.81 | 69,195,537.25 | 206,649,678.51 | 1,077,379,529.31 |

法定代表人: 王俊生 主管会计工作负责人:吴振绵 会计机构负责人:沈虹、郑薇薇

母公司所有者权益变动表

2008年1-6月

编制单位:中体产业集团股份有限公司 单位:元 币种:人民币

| 项目 | 本期金额 | 上期金额 |

| 实收资本(或股本) | 资本公积 | 减:库存股 | 盈余公积 | 未分配利润 | 所有者权益合计 | 实收资本(或股本) | 资本公积 | 减:库存股 | 盈余公积 | 未分配利润 | 所有者权益合计 |

| 一、上年年末余额 | 730,506,816.00 | 33,242,058.67 | 34,208,326.81 | -41,246,045.97 | 756,711,155.51 | 253,648,200.00 | 519,439,823.40 | 47,736,273.26 | 83,475,679.70 | 904,299,976.36 |

| 加:会计政策变更 | -19,928,114.61 | -13,527,946.45 | -76,376,135.86 | -109,832,196.92 | ||||||

| 前期差错更正 | ||||||||||

| 二、本年年初余额 | 730,506,816.00 | 33,242,058.67 | 34,208,326.81 | -41,246,045.97 | 756,711,155.51 | 253,648,200.00 | 499,511,708.79 | 34,208,326.81 | 7,099,543.84 | 794,467,779.44 |

| 三、本期增减变动金额(减少以“-”号填列) | 185,256,393.19 | 185,256,393.19 | 202,918,560.00 | -190,236,150.00 | 14,428,856.76 | 27,111,266.76 | ||||

| (一)净利润 | 185,256,393.19 | 185,256,393.19 | 44,866,640.76 | 44,866,640.76 | ||||||

| (二)直接计入所有者权益的利得和损失 | ||||||||||

| 1.可供出售金融资产公允价值变动净额 | ||||||||||

| 2.权益法下被投资单位其他所有者权益变动的影响 | ||||||||||

| 3.与计入所有者权益项目相关的所得税影响 | ||||||||||

| 4.其他 | ||||||||||

| 上述(一)和(二)小计 | 185,256,393.19 | 185,256,393.19 | 44,866,640.76 | 44,866,640.76 | ||||||

| (三)所有者投入和减少资本 | ||||||||||

| 1.所有者投入资本 | ||||||||||

| 2.股份支付计入所有者权益的金额 | ||||||||||

| 3.其他 | ||||||||||

| (四)利润分配 | -17,755,374.00 | -17,755,374.00 | ||||||||

| 1.提取盈余公积 | ||||||||||

| 2.对所有者(或股东)的分配 | -17,755,374.00 | -17,755,374.00 | ||||||||

| 3.其他 | ||||||||||

| (五)所有者权益内部结转 | 202,918,560.00 | -190,236,150.00 | -12,682,410.00 | |||||||

| 1.资本公积转增资本(或股本) | 190,236,150.00 | -190,236,150.00 | ||||||||

| 2.盈余公积转增资本(或股本) | ||||||||||

| 3.盈余公积弥补亏损 | ||||||||||

| 4.其他 | 12,682,410.00 | -12,682,410.00 | ||||||||

| 四、本期期末余额 | 730,506,816.00 | 33,242,058.67 | 34,208,326.81 | 144,010,347.22 | 941,967,548.70 | 456,566,760.00 | 309,275,558.79 | 34,208,326.81 | 21,528,400.60 | 821,579,046.20 |