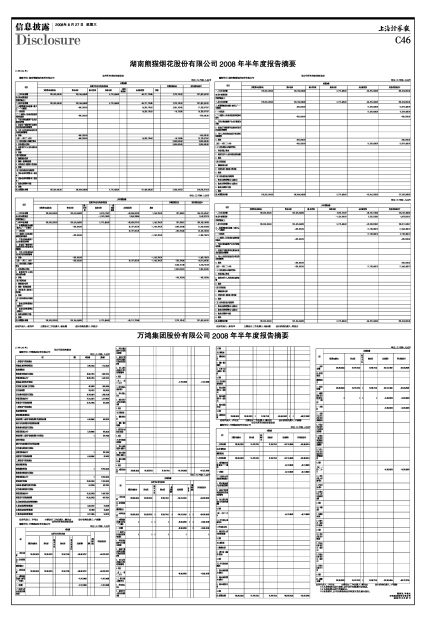

湖南熊猫烟花股份有限公司2008年半年度报告摘要

2008年08月27日 来源:上海证券报 作者:

(上接C44版)

合并所有者权益变动表

编制单位:湖南熊猫烟花股份有限公司

单位:元 币种:人民币

母公司所有者权益变动表

编制单位:湖南熊猫烟花股份有限公司

单位:元 币种:人民币

| 项目 | 本期金额 |

| 归属于母公司所有者权益 | 少数股东权益 | 所有者权益合计 |

| 实收资本(或股本) | 资本公积 | 减:库存股 | 盈余公积 | 一般风险准备 | 未分配利润 | 其他 |

| 一、上年年末余额 | 126,000,000.00 | 139,154,546.93 | 5,770,455.06 | -65,711,720.85 | 2,279,120.47 | 207,492,401.61 |

| 加:会计政策变更 | ||||||

| 前期差错更正 | ||||||

| 二、本年年初余额 | 126,000,000.00 | 139,154,546.93 | 5,770,455.06 | -65,711,720.85 | 2,279,120.47 | 207,492,401.61 |

| 三、本期增减变动金额(减少以“-”号填列) | -550,000.00 | 14,302,725.52 | 3,581,247.05 | 17,333,972.57 | ||

| (一)净利润 | 14,302,725.52 | -18,752.95 | 14,283,972.57 | |||

| (二)直接计入所有者权益的利得和损失 | -550,000.00 | -550,000.00 | ||||

| 1.可供出售金融资产公允价值变动净额 | ||||||

| 2.权益法下被投资单位其他所有者权益变动的影响 | ||||||

| 3.与计入所有者权益项目相关的所得税影响 | ||||||

| 4.其他 | -550,000.00 | -550,000.00 | ||||

| 上述(一)和(二)小计 | -550,000.00 | 14,302,725.52 | -18,752.95 | 13,733,972.57 | ||

| (三)所有者投入和减少资本 | 3,600,000.00 | 3,600,000.00 | ||||

| 1.所有者投入资本 | 3,600,000.00 | 3,600,000.00 | ||||

| 2.股份支付计入所有者权益的金额 | ||||||

| 3.其他 | ||||||

| (四)利润分配 | ||||||

| 1.提取盈余公积 | ||||||

| 2.提取一般风险准备 | ||||||

| 3.对所有者(或股东)的分配 | ||||||

| 4.其他 | ||||||

| (五)所有者权益内部结转 | ||||||

| 1.资本公积转增资本(或股本) | ||||||

| 2.盈余公积转增资本(或股本) | ||||||

| 3.盈余公积弥补亏损 | ||||||

| 4.其他 | ||||||

| 四、本期期末余额 | 126,000,000.00 | 138,604,546.93 | 5,770,455.06 | -51,408,995.33 | 5,860,367.52 | 224,826,374.18 |

单位:元 币种:人民币

| 项目 | 本期金额 |

| 实收资本(或股本) | 资本公积 | 减:库存股 | 盈余公积 | 未分配利润 | 所有者权益合计 |

| 一、上年年末余额 | 126,000,000.00 | 139,154,546.93 | 5,770,455.06 | -64,870,442.59 | 206,054,559.40 |

| 加:会计政策变更 | |||||

| 前期差错更正 | |||||

| 二、本年年初余额 | 126,000,000.00 | 139,154,546.93 | 5,770,455.06 | -64,870,442.59 | 206,054,559.40 |

| 三、本期增减变动金额(减少以“-”号填列) | -550,000.00 | 11,529,409.26 | 10,979,409.26 | ||

| (一)净利润 | 11,529,409.26 | 11,529,409.26 | |||

| (二)直接计入所有者权益的利得和损失 | -550,000.00 | -550,000.00 | |||

| 1.可供出售金融资产公允价值变动净额 | |||||

| 2.权益法下被投资单位其他所有者权益变动的影响 | |||||

| 3.与计入所有者权益项目相关的所得税影响 | |||||

| 4.其他 | -550,000.00 | -550,000.00 | |||

| 上述(一)和(二)小计 | -550,000.00 | 11,529,409.26 | 10,979,409.26 | ||

| (三)所有者投入和减少资本 | |||||

| 1.所有者投入资本 | |||||

| 2.股份支付计入所有者权益的金额 | |||||

| 3.其他 | |||||

| (四)利润分配 | |||||

| 1.提取盈余公积 | |||||

| 2.对所有者(或股东)的分配 | |||||

| 3.其他 | |||||

| (五)所有者权益内部结转 | |||||

| 1.资本公积转增资本(或股本) | |||||

| 2.盈余公积转增资本(或股本) | |||||

| 3.盈余公积弥补亏损 | |||||

| 4.其他 | |||||

| 四、本期期末余额 | 126,000,000.00 | 138,604,546.93 | 5,770,455.06 | -53,341,033.33 | 217,033,968.66 |

| 项目 | 上年同期金额 |

| 归属于母公司所有者权益 | 少数股东权益 | 所有者权益合计 |

| 实收资本(或股本) | 资本公积 | 减:库存股 | 盈余公积 | 一般风险准备 | 未分配利润 | 其他 |

| 一、上年年末余额 | 126,000,000.00 | 139,474,546.93 | 6,873,073.87 | -89,084,967.69 | 1,140,784.75 | 297,088.01 | 184,700,525.87 |

| 加:会计政策变更 | -1,102,618.81 | 2,645,289.59 | 1,542,670.78 | ||||

| 前期差错更正 | |||||||

| 二、本年年初余额 | 126,000,000.00 | 139,474,546.93 | 5,770,455.06 | -86,439,678.10 | 1,140,784.75 | 297,088.01 | 186,243,196.65 |

| 三、本期增减变动金额(减少以“-”号填列) | -320,000.00 | 20,727,957.25 | -1,140,784.75 | 1,982,032.46 | 21,249,204.96 | ||

| (一)净利润 | 20,727,957.25 | -252,674.90 | 20,475,282.35 | ||||

| (二)直接计入所有者权益的利得和损失 | -320,000.00 | -1,140,784.75 | -1,460,784.75 | ||||

| 1.可供出售金融资产公允价值变动净额 | |||||||

| 2.权益法下被投资单位其他所有者权益变动的影响 | |||||||

| 3.与计入所有者权益项目相关的所得税影响 | |||||||

| 4.其他 | -320,000.00 | -1,140,784.75 | -1,460,784.75 | ||||

| 上述(一)和(二)小计 | -320,000.00 | 20,727,957.25 | -1,140,784.75 | -252,674.90 | 19,014,497.60 | ||

| (三)所有者投入和减少资本 | 2,234,707.36 | 2,234,707.36 | |||||

| 1.所有者投入资本 | 2,400,000.00 | 2,400,000.00 | |||||

| 2.股份支付计入所有者权益的金额 | |||||||

| 3.其他 | -165,292.64 | -165,292.64 | |||||

| (四)利润分配 | |||||||

| 1.提取盈余公积 | |||||||

| 2.提取一般风险准备 | |||||||

| 3.对所有者(或股东)的分配 | |||||||

| 4.其他 | |||||||

| (五)所有者权益内部结转 | |||||||

| 1.资本公积转增资本(或股本) | |||||||

| 2.盈余公积转增资本(或股本) | |||||||

| 3.盈余公积弥补亏损 | |||||||

| 4.其他 | |||||||

| 四、本期期末余额 | 126,000,000.00 | 139,154,546.93 | 5,770,455.06 | -65,711,720.85 | 2,279,120.47 | 207,492,401.61 |

| 项目 | 上年同期金额 |

| 实收资本(或股本) | 资本公积 | 减:库存股 | 盈余公积 | 未分配利润 | 所有者权益合计 |

| 一、上年年末余额 | 126,000,000.00 | 139,474,546.93 | 6,873,073.87 | -88,215,126.94 | 184,132,493.86 |

| 加:会计政策变更 | -1,102,618.81 | 5,581,220.62 | 4,478,601.81 | ||

| 前期差错更正 | |||||

| 二、本年年初余额 | 126,000,000.00 | 139,474,546.93 | 5,770,455.06 | -82,633,906.32 | 188,611,095.67 |

| 三、本期增减变动金额(减少以“-”号填列) | -320,000.00 | 17,763,463.73 | 17,443,463.73 | ||

| (一)净利润 | 17,763,463.73 | 17,763,463.73 | |||

| (二)直接计入所有者权益的利得和损失 | -320,000.00 | -320,000.00 | |||

| 1.可供出售金融资产公允价值变动净额 | |||||

| 2.权益法下被投资单位其他所有者权益变动的影响 | |||||

| 3.与计入所有者权益项目相关的所得税影响 | |||||

| 4.其他 | -320,000.00 | -320,000.00 | |||

| 上述(一)和(二)小计 | -320,000.00 | 17,763,463.73 | 17,443,463.73 | ||

| (三)所有者投入和减少资本 | |||||

| 1.所有者投入资本 | |||||

| 2.股份支付计入所有者权益的金额 | |||||

| 3.其他 | |||||

| (四)利润分配 | |||||

| 1.提取盈余公积 | |||||

| 2.对所有者(或股东)的分配 | |||||

| 3.其他 | |||||

| (五)所有者权益内部结转 | |||||

| 1.资本公积转增资本(或股本) | |||||

| 2.盈余公积转增资本(或股本) | |||||

| 3.盈余公积弥补亏损 | |||||

| 4.其他 | |||||

| 四、本期期末余额 | 126,000,000.00 | 139,154,546.93 | 5,770,455.06 | -64,870,442.59 | 206,054,559.40 |

单位:元 币种:人民币

法定代表人: 赵伟平 主管会计工作负责人:杨沅霞 会计机构负责人:刘连方

法定代表人: 赵伟平 主管会计工作负责人:杨沅霞 会计机构负责人:刘连方