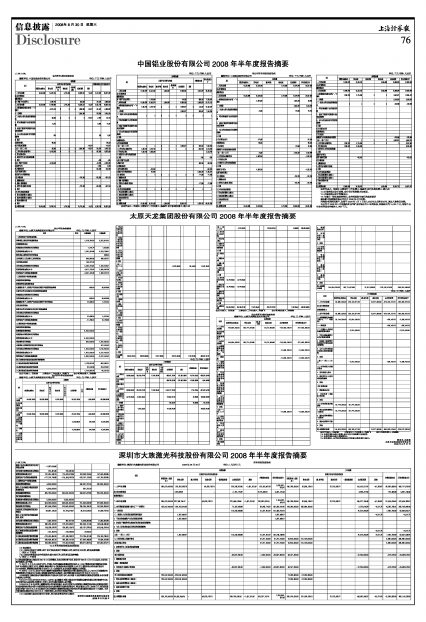

深圳市大族激光科技股份有限公司2008年半年度报告摘要

2008年08月30日 来源:上海证券报 作者:

所有者权益变动表

编制单位:深圳市大族激光科技股份有限公司 2008年06月30日 单位:(人民币)元

| 项目 | 本期金额 | 上年金额 |

| 归属于母公司所有者权益 | 少数股东权益 | 所有者权益合计 | 归属于母公司所有者权益 | 少数股东权益 | 所有者权益合计 |

| 实收资本(或股本) | 资本公积 | 减:库存股 | 盈余公积 | 一般风险准备 | 未分配利润 | 其他 | 实收资本(或股本) | 资本公积 | 减:库存股 | 盈余公积 | 一般风险准备 | 未分配利润 | 其他 |

| 一、上年年末余额 | 380,079,000.00 | 322,292,993.78 | 49,620,762.71 | 229,236,252.45 | -1,421,201.47 | 120,183,497.23 | 1,099,991,304.70 | 240,786,000.00 | 82,664,120.61 | 37,213,680.77 | 141,412,517.91 | -41,259.87 | 66,682,459.64 | 568,717,519.06 | |

| 加:会计政策变更 | -126,238.61 | - | -1,751,175.87 | 6,178,535.91 | 4,301,121.43 | 3,965,277.58 | 722,465.88 | 4,687,743.46 | |||||||

| 前期差错更正 | |||||||||||||||

| 二、本年年初余额 | 380,079,000.00 | 322,166,755.17 | - | 49,620,762.71 | 227,485,076.58 | -1,421,201.47 | 126,362,033.14 | 1,104,292,426.13 | 240,786,000.00 | 82,664,120.61 | 37,213,680.77 | 145,377,795.49 | -41,259.87 | 67,404,925.52 | 573,405,262.52 |

| 三、本年增减变动金额(减少以“-”号填列) | 228,047,400.00 | -226,759,910.93 | 72,222,958.66 | 56,845,714.07 | 130,356,161.80 | 139,293,000.00 | 238,864,200.00 | 3,275,044.78 | -9,011.75 | 14,285,735.41 | 395,708,968.44 | ||||

| (一)净利润 | 110,230,858.66 | 21,227,901.07 | 131,458,759.73 | 75,510,844.78 | 7,945,705.93 | 83,456,550.71 | |||||||||

| (二)直接计入所有者权益的利得和损失 | 1,287,489.07 | 1,287,489.07 | -9,011.75 | -9,011.75 | |||||||||||

| 1.可供出售金融资产公允价值变动净额 | 1,287,489.07 | 1,287,489.07 | |||||||||||||

| 2.权益法下被投资单位其他所有者权益变动的影响 | |||||||||||||||

| 3.与计入所有者权益项目相关的所得税影响 | |||||||||||||||

| 4.其他 | -9,011.75 | -9,011.75 | |||||||||||||

| 上述(一)和(二)小计 | 1,287,489.07 | 110,230,858.66 | 21,227,901.07 | 132,746,248.80 | 75,510,844.78 | -9,011.75 | 7,945,705.93 | 83,447,538.96 | |||||||

| (三)所有者投入和减少资本 | 37,217,813.00 | 37,217,813.00 | 18,900,000.00 | 311,100,000.00 | 6,860,000.00 | 336,860,000.00 | |||||||||

| 1.所有者投入资本 | 37,217,813.00 | 37,217,813.00 | 18,900,000.00 | 311,100,000.00 | 6,860,000.00 | 336,860,000.00 | |||||||||

| 2.股份支付计入所有者权益的金额 | |||||||||||||||

| 3.其他 | |||||||||||||||

| (四)利润分配 | -38,007,900.00 | -1,600,000.00 | -39,607,900.00 | 48,157,200.00 | -72,235,800.00 | -519,970.52 | -24,598,570.52 | ||||||||

| 1.提取盈余公积 | |||||||||||||||

| 2.提取一般风险准备 | |||||||||||||||

| 3.对所有者(或股东)的分配 | -38,007,900.00 | -1,600,000.00 | -39,607,900.00 | 48,157,200.00 | -72,235,800.00 | -519,970.52 | -24,598,570.52 | ||||||||

| 4.其他 | |||||||||||||||

| (五)所有者权益内部结转 | 228,047,400.00 | -228,047,400.00 | 72,235,800.00 | -72,235,800.00 | |||||||||||

| 1.资本公积转增资本(或股本) | 228,047,400.00 | -228,047,400.00 | 72,235,800.00 | -72,235,800.00 | |||||||||||

| 2.盈余公积转增资本(或股本) | |||||||||||||||

| 3.盈余公积弥补亏损 | |||||||||||||||

| 4.其他 | |||||||||||||||

| 四、本期期末余额 | 608,126,400.00 | 95,406,844.24 | - | 49,620,762.71 | 299,708,035.24 | -1,421,201.47 | 183,207,747.21 | 1,234,648,587.93 | 380,079,000.00 | 321,528,320.61 | 37,213,680.77 | 148,652,840.27 | -50,271.62 | 81,690,660.93 | 969,114,230.96 |

(上接75版)

| 取得子公司及其他营业单位支付的现金净额 | -1,937,594.40 | |||

| 支付其他与投资活动有关的现金 | 613,461.80 | 613,461.80 | ||

| 投资活动现金流出小计 | 191,901,530.70 | 174,476,373.66 | 162,809,216.53 | 157,825,699.85 |

| 投资活动产生的现金流量净额 | -177,215,758.86 | -174,434,292.26 | -162,187,175.83 | -157,759,639.85 |

| 三、筹资活动产生的现金流量: | ||||

| 吸收投资收到的现金 | 4,000,000.00 | 342,951,211.00 | 342,090,000.00 | |

| 其中:子公司吸收少数股东投资收到的现金 | 4,000,000.00 | 861,211.00 | ||

| 取得借款收到的现金 | 495,760,000.00 | 405,000,000.00 | 358,591,879.99 | 230,000,000.00 |

| 发行债券收到的现金 | ||||

| 收到其他与筹资活动有关的现金 | 3,500,000.00 | 3,500,000.00 | ||

| 筹资活动现金流入小计 | 503,260,000.00 | 408,500,000.00 | 701,543,090.99 | 572,090,000.00 |

| 偿还债务支付的现金 | 307,505,573.00 | 219,500,000.00 | 235,234,194.79 | 110,000,000.00 |

| 分配股利、利润或偿付利息支付的现金 | 60,681,130.22 | 52,794,278.27 | 35,312,024.20 | 31,686,787.50 |

| 其中:子公司支付给少数股东的股利、利润 | ||||

| 支付其他与筹资活动有关的现金 | 1,033,767.00 | 697,617.00 | 11,858,892.96 | 11,858,892.96 |

| 筹资活动现金流出小计 | 369,220,470.22 | 272,991,895.27 | 282,405,111.95 | 153,545,680.46 |

| 筹资活动产生的现金流量净额 | 134,039,529.78 | 135,508,104.73 | 419,137,979.04 | 418,544,319.54 |

| 四、汇率变动对现金及现金等价物的影响 | -101,263.74 | -116,290.23 | -9,900.47 | |

| 五、现金及现金等价物净增加额 | -173,410,858.10 | -121,425,283.12 | 211,765,411.98 | 225,159,786.41 |

| 加:期初现金及现金等价物余额 | 429,404,455.10 | 293,428,101.50 | 157,806,445.56 | 76,494,029.36 |

| 六、期末现金及现金等价物余额 | 255,993,597.00 | 172,002,818.38 | 369,571,857.54 | 301,653,815.77 |

7.2.4 所有者权益变动表(见附表)

7.3 报表附注

7.3.1 如果出现会计政策、会计估计变更或会计差错更正的,说明有关内容、原因及影响数

□ 适用 √ 不适用

7.3.2 如果财务报表合并范围发生重大变化的,说明原因及影响数

√ 适用 □ 不适用

| *5 SHARP FOCUS INTERNATIONAL LIMITED是大族激光(香港)有限公司于英属维尔京群岛注册设立的全资离岸子公司,公司法定代表人是高云峰,注册资本5万美元,本公司本期内将其纳入合并范围。 *6 2008 年6 月25 日公司第三届董事会第十次会议审议通过,本公司之控股子公司深圳市大族数控科技有限公司将其持有的江西大族电源科技有限公司的51%股权转让给本公司大股东深圳市大族实业有限公司, 转让价款为人民币2,844.35万元,相关股权变更登记手续于2008年6月30日办理完毕,转让后深圳市大族数控科技有限公司持有江西大族电源科技有限公司17.1%股权。江西大族电源科技有限公司自2008年6月1日起不再纳入本公司会计报表合并范围。 |

7.3.3 如果被出具非标准审计报告,列示涉及事项的有关附注

深圳市大族激光科技股份有限公司

2008年8月28日