§9 财务报告

9.1 审计意见

| 审计报告 | 标准无保留审计意见 |

| 审计报告正文 | |

| 中国北京 中国注册会计师:李洪斌 2009年3月24日 | |

9.2 财务报表

9.2.1 资产负债表

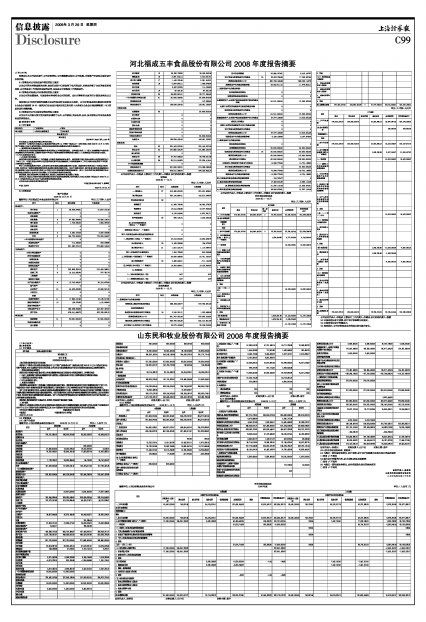

编制单位:山东民和牧业股份有限公司 2008年12月31日 单位:(人民币)元

| 项目 | 期末余额 | 年初余额 | ||

| 合并 | 母公司 | 合并 | 母公司 | |

| 流动资产: | ||||

| 货币资金 | 274,131,080.13 | 256,632,822.69 | 60,300,089.22 | 49,434,541.70 |

| 结算备付金 | ||||

| 拆出资金 | ||||

| 交易性金融资产 | ||||

| 应收票据 | 808,454.90 | |||

| 应收账款 | 21,458,540.50 | 18,323,875.03 | 18,641,822.05 | 8,042.24 |

| 预付款项 | 74,547,545.31 | 69,344,102.43 | 17,863,657.24 | 15,452,855.10 |

| 应收利息 | ||||

| 应收股利 | ||||

| 其他应收款 | 1,732,789.12 | 28,928,256.64 | 85,752.00 | 30,741,618.27 |

| 买入返售金融资产 | ||||

| 存货 | 157,439,554.58 | 117,099,541.47 | 135,284,511.53 | 107,783,421.35 |

| 一年内到期的非流动资产 | ||||

| 其他流动资产 | ||||

| 流动资产合计 | 529,309,509.64 | 490,328,598.26 | 232,984,286.94 | 203,420,478.66 |

| 非流动资产: | ||||

| 发放贷款及垫款 | ||||

| 可供出售金融资产 | ||||

| 持有至到期投资 | ||||

| 长期应收款 | ||||

| 长期股权投资 | 22,357,000.00 | 5,000,000.00 | 27,357,136.54 | |

| 投资性房地产 | ||||

| 固定资产 | 319,844,989.45 | 268,335,549.05 | 306,490,633.44 | 266,014,845.60 |

| 在建工程 | 101,321,161.63 | 101,129,655.40 | 49,475,279.71 | 44,191,206.47 |

| 工程物资 | ||||

| 固定资产清理 | ||||

| 生产性生物资产 | ||||

| 油气资产 | ||||

| 无形资产 | 39,697,949.56 | 35,674,188.90 | 40,943,433.71 | 36,820,164.01 |

| 开发支出 | ||||

| 商誉 | 751,365.04 | |||

| 长期待摊费用 | 31,608,071.52 | 31,608,071.52 | 24,566,368.15 | 24,559,964.65 |

| 递延所得税资产 | 14,550.17 | 266,900.96 | ||

| 其他非流动资产 | ||||

| 非流动资产合计 | 492,486,722.33 | 459,104,464.87 | 427,493,981.01 | 398,943,317.27 |

| 资产总计 | 1,021,796,231.97 | 949,433,063.13 | 660,478,267.95 | 602,363,795.93 |

| 流动负债: | ||||

| 短期借款 | 307,120,000.00 | 267,120,000.00 | 217,860,000.00 | 189,860,000.00 |

| 应付票据 | ||||

| 应付账款 | 56,504,687.59 | 36,905,331.54 | 87,526,987.47 | 83,324,526.83 |

| 预收款项 | 238,286.66 | 57,818.00 | 2,191,741.19 | 9,375.11 |

| 卖出回购金融资产款 | ||||

| 应付手续费及佣金 | ||||

| 应付职工薪酬 | 9,971,042.36 | 8,069,332.89 | 8,165,755.26 | 7,016,329.92 |

| 应交税费 | -8,621,226.10 | 900,294.38 | -1,256,846.56 | 1,341,175.41 |

| 应付利息 | ||||

| 应付股利 | ||||

| 其他应付款 | 4,207,362.13 | 3,995,362.13 | 3,422,314.15 | 3,422,314.15 |

| 一年内到期的非流动负债 | 10,000,000.00 | 10,000,000.00 | ||

| 其他流动负债 | ||||

| 流动负债合计 | 379,420,152.64 | 327,048,138.94 | 317,909,951.51 | 284,973,721.42 |

| 非流动负债: | ||||

| 长期借款 | 10,000,000.00 | 10,000,000.00 | 30,000,000.00 | 30,000,000.00 |

| 应付债券 | ||||

| 长期应付款 | 5,400,000.00 | 5,400,000.00 | 5,350,667.15 | |

| 专项应付款 | ||||

| 预计负债 | ||||

| 递延所得税负债 | ||||

| 递延收益 | 800,000.00 | 800,000.00 | 833,257.50 | 800,000.00 |

| 其他非流动负债 | ||||

| 非流动负债合计 | 16,200,000.00 | 16,200,000.00 | 36,183,924.65 | 30,800,000.00 |

| 负债合计 | 395,620,152.64 | 343,248,138.94 | 354,093,876.16 | 315,773,721.42 |

| 所有者权益(或股东权益): | ||||

| 实收资本(或股本) | 107,500,000.00 | 107,500,000.00 | 80,500,000.00 | 80,500,000.00 |

| 资本公积 | 241,691,007.27 | 241,795,722.89 | 749,837.45 | 103,359.43 |

| 减:库存股 | ||||

| 盈余公积 | 99,114,268.73 | 99,114,268.73 | 94,024,020.11 | 94,024,020.11 |

| 一般风险准备 | ||||

| 未分配利润 | 166,925,376.40 | 157,774,932.57 | 120,490,944.06 | 111,962,694.97 |

| 外币报表折算差额 | ||||

| 归属于母公司所有者权益合计 | 615,230,652.40 | 606,184,924.19 | 295,764,801.62 | 286,590,074.51 |

| 少数股东权益 | 10,945,426.93 | 10,619,590.17 | ||

| 所有者权益合计 | 626,176,079.33 | 606,184,924.19 | 306,384,391.79 | 286,590,074.51 |

| 负债和所有者权益总计 | 1,021,796,231.97 | 949,433,063.13 | 660,478,267.95 | 602,363,795.93 |

法定代表人:孙希民 财务负责人:吕中民 财务主管:曲平

9.2.2 利润表

编制单位:山东民和牧业股份有限公司 2008年1-12月 单位:(人民币)元

| 项目 | 本期金额 | 上期金额 | ||

| 合并 | 母公司 | 合并 | 母公司 | |

| 一、营业总收入 | 812,083,075.94 | 556,202,284.31 | 564,376,287.81 | 364,272,557.50 |

| 其中:营业收入 | 812,083,075.94 | 556,202,284.31 | 564,376,287.81 | 364,272,557.50 |

| 利息收入 | ||||

| 二、营业总成本 | 754,830,428.61 | 499,627,087.57 | 469,664,552.13 | 285,323,689.61 |

| 其中:营业成本 | 694,135,822.78 | 452,748,423.41 | 427,498,571.47 | 251,829,685.67 |

| 利息支出 | ||||

| 营业税金及附加 | 847.50 | 847.50 | ||

| 销售费用 | 13,232,218.14 | 8,191,802.26 | 10,442,951.11 | 6,975,930.15 |

| 管理费用 | 25,782,021.66 | 19,493,759.65 | 16,880,647.15 | 13,731,654.65 |

| 财务费用 | 21,540,471.53 | 19,115,248.26 | 15,169,460.33 | 13,294,858.57 |

| 资产减值损失 | 139,894.50 | 77,853.99 | -327,925.43 | -509,286.93 |

| 加:公允价值变动收益(损失以“-”号填列) | ||||

| 投资收益(损失以“-”号填列) | 636,400.00 | 636,400.00 | ||

| 其中:对联营企业和合营企业的投资收益 | ||||

| 汇兑收益(损失以“-”号填列) | ||||

| 三、营业利润(亏损以“-”号填列) | 57,889,047.33 | 57,211,596.74 | 94,711,735.68 | 78,948,867.89 |

| 加:营业外收入 | 1,445,903.99 | 712,891.89 | 1,599,488.43 | 832,852.26 |

| 减:营业外支出 | 6,485,119.98 | 6,404,888.19 | 5,312,131.07 | 5,310,696.07 |

| 其中:非流动资产处置损失 | 5,161,801.51 | 5,081,569.72 | ||

| 四、利润总额(亏损总额以“-”号填列) | 52,849,831.34 | 51,519,600.44 | 90,999,093.04 | 74,471,024.08 |

| 减:所得税费用 | 999,278.76 | 617,114.22 | 1,892,400.38 | |

| 五、净利润(净亏损以“-”号填列) | 51,850,552.58 | 50,902,486.22 | 89,106,692.66 | 74,471,024.08 |

| 归属于母公司所有者的净利润 | 51,524,714.38 | 84,716,351.22 | ||

| 少数股东损益 | 325,838.20 | 4,390,341.44 | ||

| 六、每股收益: | ||||

| (一)基本每股收益 | 0.54 | 1.05 | 0.00 | |

| (二)稀释每股收益 | 0.54 | 1.05 | 0.00 |

法定代表人:孙希民 财务负责人:吕中民 财务主管:曲平

9.2.3 现金流量表

编制单位:山东民和牧业股份有限公司 2008年1-12月 单位:(人民币)元

| 项目 | 本期金额 | 上期金额 | ||

| 合并 | 母公司 | 合并 | 母公司 | |

| 一、经营活动产生的现金流量: | ||||

| 销售商品、提供劳务收到的现金 | 837,275,725.00 | 545,554,672.04 | 604,868,406.83 | 380,374,603.23 |

| 收到的税费返还 | 4,675,669.08 | 2,050,712.39 | ||

| 收到其他与经营活动有关的现金 | 4,953,221.63 | 1,829,884.11 | 14,405,088.83 | 30,286,022.37 |

| 经营活动现金流入小计 | 846,904,615.71 | 547,384,556.15 | 621,324,208.05 | 410,660,625.60 |

| 购买商品、接受劳务支付的现金 | 683,363,276.91 | 430,093,446.07 | 456,907,233.83 | 253,122,792.32 |

| 支付给职工以及为职工支付的现金 | 73,836,515.97 | 57,270,889.09 | 56,520,307.54 | 45,759,662.89 |

| 支付的各项税费 | 3,800,067.77 | 1,138,211.72 | 407,822.04 | 66,988.48 |

| 支付其他与经营活动有关的现金 | 36,774,674.00 | 16,399,920.51 | 31,749,420.81 | 34,812,687.75 |

| 经营活动现金流出小计 | 797,774,534.65 | 504,902,467.39 | 545,584,784.22 | 333,762,131.44 |

| 经营活动产生的现金流量净额 | 49,130,081.06 | 42,482,088.76 | 75,739,423.83 | 76,898,494.16 |

| 二、投资活动产生的现金流量: | ||||

| 收回投资收到的现金 | 5,636,400.00 | 5,636,400.00 | 20,020,000.00 | 5,020,000.00 |

| 取得投资收益收到的现金 | ||||

| 处置固定资产、无形资产和其他长期资产收回的现金净额 | 172,738.00 | 14,000.00 | ||

| 处置子公司及其他营业单位收到的现金净额 | 0.00 | |||

| 收到其他与投资活动有关的现金 | ||||

| 投资活动现金流入小计 | 5,636,400.00 | 5,636,400.00 | 20,192,738.00 | 5,034,000.00 |

| 购建固定资产、无形资产和其他长期资产支付的现金 | 170,081,538.08 | 160,555,903.93 | 125,977,424.24 | 124,261,389.29 |

| 投资支付的现金 | 2,400,000.00 | 2,400,000.00 | ||

| 质押贷款净增加额 | ||||

| 取得子公司及其他营业单位支付的现金净额 | ||||

| 支付其他与投资活动有关的现金 | ||||

| 投资活动现金流出小计 | 172,481,538.08 | 162,955,903.93 | 125,977,424.24 | 124,261,389.29 |

| 投资活动产生的现金流量净额 | -166,845,138.08 | -157,319,503.93 | -105,784,686.24 | -119,227,389.29 |

| 三、筹资活动产生的现金流量: | ||||

| 吸收投资收到的现金 | 273,970,000.00 | 273,970,000.00 | ||

| 其中:子公司吸收少数股东投资收到的现金 | ||||

| 取得借款收到的现金 | 317,920,000.00 | 277,920,000.00 | 303,010,000.00 | 279,860,000.00 |

| 发行债券收到的现金 | ||||

| 收到其他与筹资活动有关的现金 | 3,662,444.09 | |||

| 筹资活动现金流入小计 | 591,890,000.00 | 551,890,000.00 | 306,672,444.09 | 279,860,000.00 |

| 偿还债务支付的现金 | 233,260,000.00 | 205,260,000.00 | 236,140,000.00 | 192,120,000.00 |

| 分配股利、利润或偿付利息支付的现金 | 22,612,191.84 | 20,277,603.84 | 15,650,430.11 | 13,534,835.11 |

| 其中:子公司支付给少数股东的股利、利润 | ||||

| 支付其他与筹资活动有关的现金 | 4,316,700.00 | 4,316,700.00 | ||

| 筹资活动现金流出小计 | 260,188,891.84 | 229,854,303.84 | 251,790,430.11 | 205,654,835.11 |

| 筹资活动产生的现金流量净额 | 331,701,108.16 | 322,035,696.16 | 54,882,013.98 | 74,205,164.89 |

| 四、汇率变动对现金及现金等价物的影响 | -155,060.23 | -304,290.03 | ||

| 五、现金及现金等价物净增加额 | 213,830,990.91 | 207,198,280.99 | 24,532,461.54 | 31,876,269.76 |

| 加:期初现金及现金等价物余额 | 60,300,089.22 | 49,434,541.70 | 35,767,627.68 | 17,558,271.94 |

| 六、期末现金及现金等价物余额 | 274,131,080.13 | 256,632,822.69 | 60,300,089.22 | 49,434,541.70 |

法定代表人:孙希民 财务负责人:吕中民 财务主管:曲平

9.2.4 所有者权益变动表(见附表)

9.3 与最近一期年度报告相比,会计政策、会计估计和核算方法发生变化的具体说明

□ 适用 √ 不适用

9.4 重大会计差错的内容、更正金额、原因及其影响

□ 适用 √ 不适用

9.5 与最近一期年度报告相比,合并范围发生变化的具体说明

□ 适用 √ 不适用

法定代表人:孙希民

山东民和牧业股份有限公司

二〇〇九年三月二十六日

| 项目 | 本期金额 | 上年金额 |

| 归属于母公司所有者权益 | 少数股东权益 | 所有者权益合计 | 归属于母公司所有者权益 | 少数股东权益 | 所有者权益合计 |

| 实收资本(或股本) | 资本公积 | 减:库存股 | 盈余公积 | 一般风险准备 | 未分配利润 | 其他 | 实收资本(或股本) | 资本公积 | 减:库存股 | 盈余公积 | 一般风险准备 | 未分配利润 | 其他 |

| 一、上年年末余额 | 80,500,000.00 | 749,837.45 | 94,024,020.11 | 120,490,944.06 | 10,619,590.17 | 306,384,391.79 | 80,500,000.00 | 749,700.91 | 86,576,917.70 | 43,221,695.25 | 8,629,351.85 | 219,677,665.71 |

| 加:会计政策变更 | ||||||||||||

| 前期差错更正 | ||||||||||||

| 其他 | ||||||||||||

| 二、本年年初余额 | 80,500,000.00 | 749,837.45 | 94,024,020.11 | 120,490,944.06 | 10,619,590.17 | 306,384,391.79 | 80,500,000.00 | 749,700.91 | 86,576,917.70 | 43,221,695.25 | 8,629,351.85 | 219,677,665.71 |

| 三、本年增减变动金额(减少以“-”号填列) | 27,000,000.00 | 240,941,169.82 | 5,090,248.62 | 46,434,432.34 | 325,836.76 | 319,791,687.54 | 136.54 | 7,447,102.41 | 77,269,248.81 | 1,990,238.32 | 86,706,726.08 | |

| (一)净利润 | 51,524,714.38 | 325,838.20 | 51,850,552.58 | 84,716,351.22 | 4,390,341.44 | 89,106,692.66 | ||||||

| (二)直接计入所有者权益的利得和损失 | 136.54 | 136.54 | ||||||||||

| 1.可供出售金融资产公允价值变动净额 | ||||||||||||

| 2.权益法下被投资单位其他所有者权益变动的影响 | 136.54 | 136.54 | ||||||||||

| 3.与计入所有者权益项目相关的所得税影响 | ||||||||||||

| 4.其他 | ||||||||||||

| 上述(一)和(二)小计 | 51,524,714.38 | 325,838.20 | 51,850,552.58 | 136.54 | 84,716,351.22 | 4,390,341.44 | 89,106,829.20 | |||||

| (三)所有者投入和减少资本 | 27,000,000.00 | 240,941,169.82 | 267,941,169.82 | -2,400,103.12 | -2,400,103.12 | |||||||

| 1.所有者投入资本 | 27,000,000.00 | 240,941,169.82 | 267,941,169.82 | -2,400,103.12 | -2,400,103.12 | |||||||

| 2.股份支付计入所有者权益的金额 | ||||||||||||

| 3.其他 | ||||||||||||

| (四)利润分配 | 5,090,248.62 | -5,090,282.04 | -1.44 | -34.86 | 7,447,102.41 | -7,447,102.41 | ||||||

| 1.提取盈余公积 | 5,090,248.62 | -5,090,248.62 | 7,447,102.41 | -7,447,102.41 | ||||||||

| 2.提取一般风险准备 | ||||||||||||

| 3.对所有者(或股东)的分配 | ||||||||||||

| 4.其他 | -33.42 | -1.44 | -34.86 | |||||||||

| (五)所有者权益内部结转 | ||||||||||||

| 1.资本公积转增资本(或股本) | ||||||||||||

| 2.盈余公积转增资本(或股本) | ||||||||||||

| 3.盈余公积弥补亏损 | ||||||||||||

| 4.其他 | ||||||||||||

| 四、本期期末余额 | 107,500,000.00 | 241,691,007.27 | 99,114,268.73 | 166,925,376.40 | 10,945,426.93 | 626,176,079.33 | 80,500,000.00 | 749,837.45 | 94,024,020.11 | 120,490,944.06 | 10,619,590.17 | 306,384,391.79 |

法定代表人:孙希民 财务负责人:吕中民 财务主管:曲平

所有者权益变动表

编制单位:山东民和牧业股份有限公司 2008年度 单位:(人民币)元