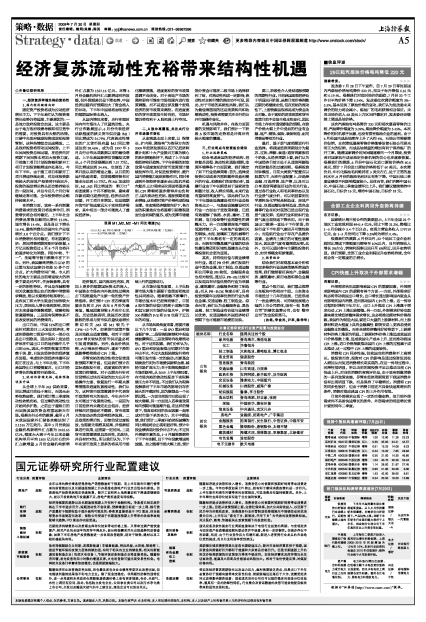

| 板块 | 市场表现 | 调研结论 | 评级/ | 关注个股 |

| 汽车 | 供需形势向好驱动行业连续上行,后期有继续上扬的潜力。 | 下半年中高排量车型比重将逐渐提高,从5、6月份排量轿车销量看,在需求仍向好前提下,产品结构上移。判断下半年轿车行业盈利能力将好于上半年,相应部分主流公司下半年盈利环比上升将非常明显。 | 国海 | 长安汽车 证券 一汽富维 |

| 银行 | 中报预期推动了银行股有望继续上行。 | 上市银行二季度开始进入盈利环比增长的黄金期,上调2009-2010年利润增速为12%和16%,未来行业投资机会源自2010年估值提升,维持行业强于大市投资评级。 | 东方 | 兴业银行 证券 深发展A |

| 电力 | 资产整合和补涨潜力成为电力行业上行的催化剂。 | 电力补涨行情仍在延续,在低碳主题下水电投资价值将日益显现,而且水电电价上调预期也更为明确,看好长江电力、国电电力和国投电力。 | 兴业 | 郴电国际 证券 涪陵电力 |