兴业银行(601166):估值与成长性皆优的银行股

2009年12月13日 来源:上海证券报 作者:

兴业银行是银行股里价格最高的,但同时又是估值最低的银行股,这都得益于优异的业绩水平,以及相对更好的资产质量和比较清晰的业绩增长前景。目前大多数银行股均受到核心资本充足率不足,并为此有再融资需求的困扰,兴业银行同样不例外。但兴业银行的再融资需求因受到大股东的有力支持却由“利空”转型为行情的“利好”。原因在于采取了配股的模式(大股东一样需要拿钱来支持),并且由于融资规模不大的原因,核算下来的配股价非常低廉,使得参加配股的投资者能获取到新的低成本筹码,因而对行情构成一个有利因素。低估值+高成长性+低价配股催化剂的作用,必然会促使机构投资者增加对该股的配置比重,并促使行情更上层楼。

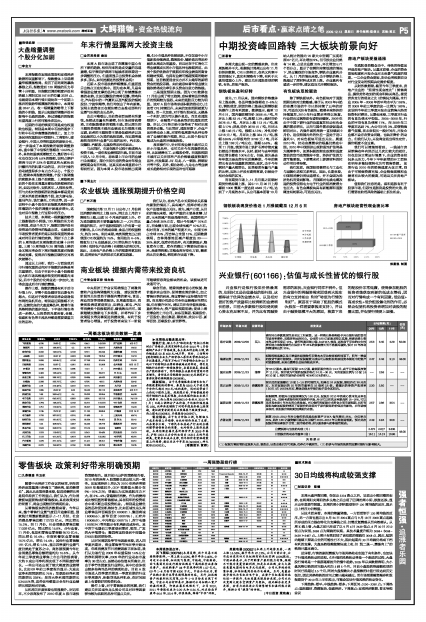

| 评级机构 | 评级日期 | 股票评级 | 投资要点 | EPS预测(元) | 估值 (元) | ||

| 09年 | 10年 | 11年 | |||||

| 东方证券 | 2009/12/09 | 买入 | 该行同业存款稳定性甚至比工行更强,这一特殊业务结构给予兴业银行高的货币市场利率弹性,且稳定性远胜同业。公司的180 亿配股若得以实施,将提高核心资本充足率至接近10%。该行的盈利能力强,RoRWA 较高,这种高于平均的内生性增长能力将使得该行在保持3年25%的贷款增长而不需要再融资。预计10年净利润增速将达到35%。 | 2.53 | 3.45 | 4.29 | 50.00 |

| 海通证券 | 2009/11/23 | 买入 | 配股即将实施以及三季度次级债发行后资本水平比较宽裕的局面下,明年一季度的放贷节奏可能较快。此次配股融资完成后可以较轻松地实现资本规划中的资产和贷款预期,未来业绩增长会保持较高水平。 | 2.47 | 2.48 | 3.13 | 48.00 |

| 国元证券 | 2009/11/23 | 推荐 | 按 50 亿股本,最高可配股12.5 亿股,最低配股价格为14.4 元,高于目前每股净资产 11.2元。预计较为可能的配股价格在24 元-36 元,对应配股比例为10 配1.5和10 配1,相对市场均价分别有40%和10%的折让。 | -- | 2.58 | -- | -- |

| 东北证券 | 2009/11/23 | 谨慎推荐 | 预计此次配股额在10配1-1.5的可能性大,如果在24元配股,除权价在38元左右,对应配股后的10 年的市盈率在15倍和2.5倍,摊薄后的净资产收益率(ROE)在16.53%左右,整体估值水平依旧处于安全区间内。 | 2.30 | 2.50 | -- | -- |

| 国信证券 | 2009/11/23 | 谨慎推荐 | 根据测算,即使兴业配股规模仅为150亿元,配股后2010年的核心资本充足率也超过9%。如果考虑发行相关债券的手段,兴业可以把充足率提高到15-16%,可以支持其未来5年左右的业务发展。兴业银行的配股方式符合之前市场预期,在所有股东均参加配股的情况下配股价的高低对于原有股东的价值没有影响,在市场较乐观时,低配股价将短期支撑股价走强。 | 2.57 | 2.86 | 3.54 | -- |

| 齐鲁证券 | 2009/11/23 | 推荐 | 测算2010-2012年兴业银行的风险加权资产RWA 每年增长25%,分红率在20%,此次180 亿融资额可满足兴业银行2010-2012年业务发展需要。预计此次配股价将显著低于目前二级市场价格,所以股东参与的积极性较高。 | 2.49 | 2.94 | 3.58 | -- |

| 业绩预测与估值的均值(元) | 2.472 | 2.817 | 3.635 | 49.00 | |||

| 目前股价的动态市盈率(倍) | 16.11 | 14.13 | 10.95 | ||||

| 风 险 提 示 | |||||||

| (1)配股方案还需经过股东大会、银监会、证监会准后方可实施,仍存在不确定性。(2)经济与市场的系统性因素对银行业影响较大。 |