太阳纸业是所有造纸上市公司中盈利能力最强的公司之一,因而在2009年的业绩复苏也是最快。机构调研信息显示,行业复苏加上出口复苏使得该公司所有门类的产品自去年三季度起一直处于供不应求状态,因此该公司的三大主要产品均已形成再次提价需求,在产品价量齐增中带来经营业绩的新增长。

此外,该公司自上市以来一直保持了每年均有不菲分红的分配政策,除2008年金融危机氛围中没有股本扩张以外,其他年度也都保持了每年都有转增的记录,使得投资者在看好其优良的业绩之外,也对年报的分配有了较好的期待。

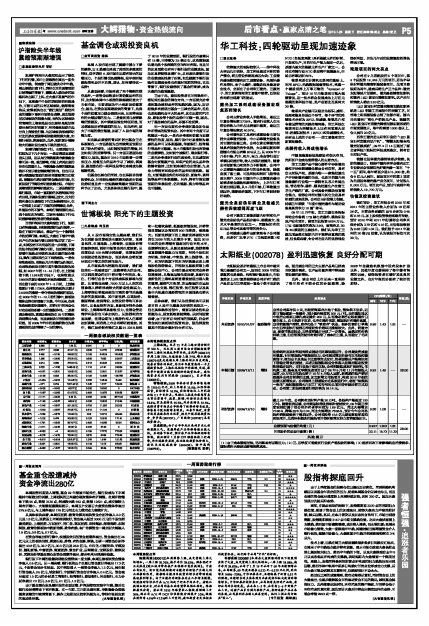

评级机构 评级日期 股票评级 投资要点 EPS预测(元) 估值(元)

09年 10年 11年

兴业证券 2010/01/07 强烈推荐 当前公司库存仅3天,而经销商库存亦处于低位,整体供不应求,近期可能酝酿新一轮提价,预计提价幅度约200元/吨。当前富阳地区中低档白板纸已率先成功提价200元,从而推动高档白纸板提价已箭在弦上。白卡纸供不应求,也存在涨价预期,铜版纸亦有提价意愿,当前销量满产满销,库存仍处于“零库存”状态。较多的高价订单集中在四季度执行使得四季度财务价格环比涨幅较大。此外,销量方面,受春节效应拉动,四季度销量亦出现了一定增长。虽然原料价格持续上涨,但自制浆的使用有效抑制了成本的上涨,从而稳定了毛利率。 0.98 1.43 1.81 --

申银万国 2009/12/11 增持 优势纸种及原材料结构特点推动毛利率快速回升,公司最快完成盈利修复。针对铜版纸产能释放压力,公司通过增加非涂布文化纸和提高烟卡、液包白卡及食品卡比重等方式应对,前者因落后产能淘汰和下游稳定增长而受益,后者则因国际纸业合作渐入佳境而驱动投资收益稳步回升。在行业处于低谷之际,公司把握低成本扩张时机,化机浆二期、热电及化学浆技改项目已于09年5月和11月相继投入运营,40万吨文化纸也将于10年4月投入运营。新浆线的投产将明显提升公司自制浆的比重,加之新增文化纸项目,构成2010年起的业绩主要增长点。公司海外上游建设亦在积极进行中,老挝“林浆纸一体化”及配套越南木片加工厂和专用码头项目待审核后将正式启动。公司第二期股权激励行权价格为24.14元。 0.92 1.40 -- 28.00

湘财证券 2009/12/10 增持 截止09年底,公司拥有原材料产能30万吨,各纸种产能超过120万吨。随着经济回暖,公司铜版纸等优势纸种受益较大,09年第三季度实现归属于母公司所有者净利润为1.69亿元,同比大幅增加73.95%,稀释EPS 为0.34,同比大幅增加78.95%,预计今年公司各纸种将继续受益于需求回升。公司拟投资15.6亿元建设高松厚度纯质纸项目,此类环保概念的造纸项目得到政策支持力度将逐渐加大。 0.88 1.08 -- --

业绩预测与估值的均值(元) 0.927 1.303 1.81 28.00

目前股价的动态市盈率(倍) 22.11 15.73 11.33

风 险 提 示

(1)由于成本涨幅过快,毛利率或有回落压力;(2)三、四季度可能受到行业新产能投放的影响;(3)经济再次下滑影响纸业消费需求、国际浆价大幅波动影响购浆成本。