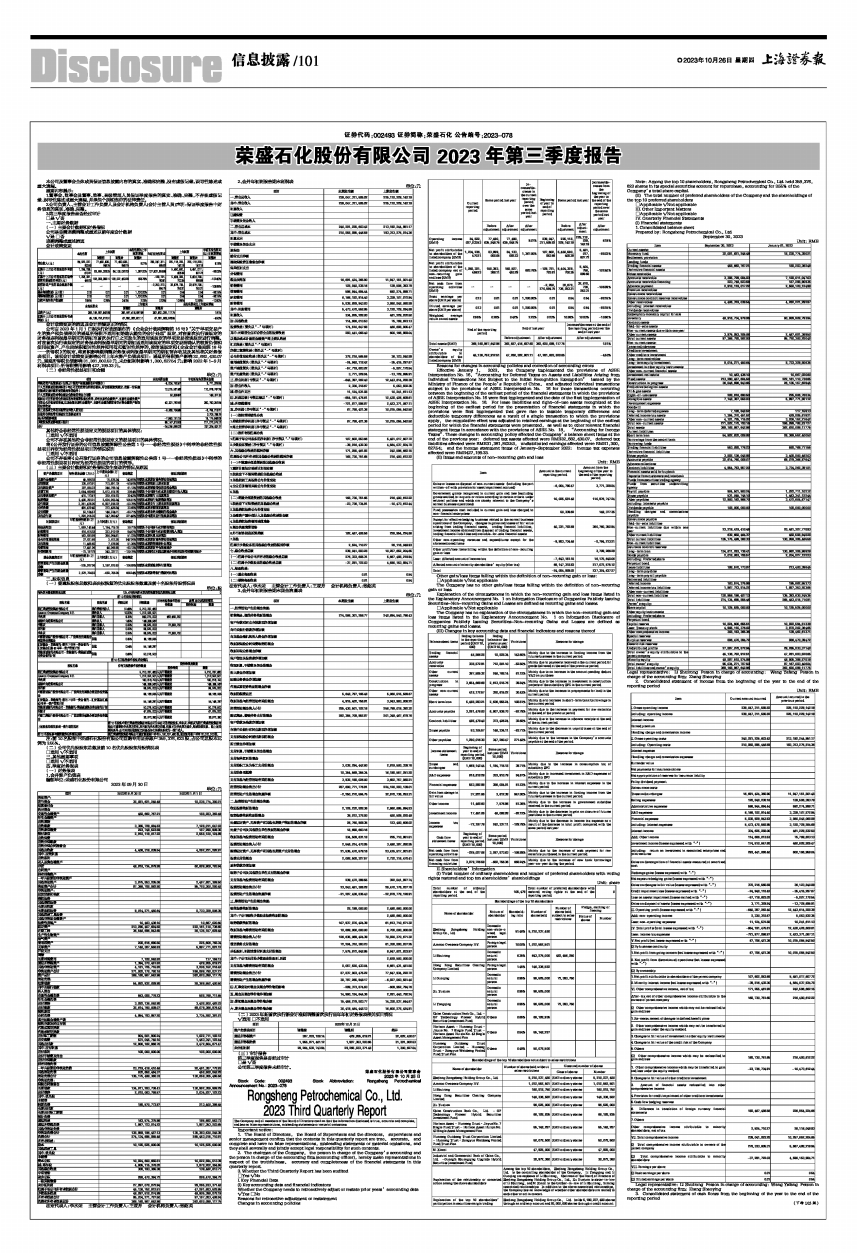

荣盛石化股份有限公司 2023年第三季度报告

证券代码:002493 证券简称:荣盛石化 公告编号:2023-078

本公司及董事会全体成员保证信息披露内容的真实、准确和完整,没有虚假记载、误导性陈述或重大遗漏。

重要内容提示:

1.董事会、监事会及董事、监事、高级管理人员保证季度报告的真实、准确、完整,不存在虚假记载、误导性陈述或重大遗漏,并承担个别和连带的法律责任。

2.公司负责人、主管会计工作负责人及会计机构负责人(会计主管人员)声明:保证季度报告中财务信息的真实、准确、完整。

3.第三季度报告是否经过审计

□是 √否

一、主要财务数据

(一) 主要会计数据和财务指标

公司是否需追溯调整或重述以前年度会计数据

√是 □否

追溯调整或重述原因

会计政策变更

■

会计政策变更的原因及会计差错更正的情况

公司自2023年1月1日起执行财政部颁布的《企业会计准则解释第16号》“关于单项交易产生的资产和负债相关的递延所得税不适用初始确认豁免的会计处理”规定,对在首次执行该规定的财务报表列报最早期间的期初至首次执行日之间发生的适用该规定的单项交易按该规定进行调整。对在首次执行该规定的财务报表列报最早期间的期初因适用该规定的单项交易而确认的租赁负债和使用权资产,产生应纳税暂时性差异和可抵扣暂时性差异的,按照该规定和《企业会计准则第18号一一所得税》的规定,将累积影响数调整财务报表列报最早期间的期初留存收益及其他相关财务报表项目。该项会计政策变更影响公司上年末资产负债表项目:递延所得税资产影响32,682,430.07元,递延所得税负债影响31,381,802.53元,未分配利润影响1,300,627.54元;影响2022年1-9月利润表项目:所得税费用影响427,199.33元。

(二) 非经常性损益项目和金额

单位:元

■

其他符合非经常性损益定义的损益项目的具体情况:

□适用 √不适用

公司不存在其他符合非经常性损益定义的损益项目的具体情况。

将《公开发行证券的公司信息披露解释性公告第1号一一非经常性损益》中列举的非经常性损益项目界定为经常性损益项目的情况说明

□适用 √不适用

公司不存在将《公开发行证券的公司信息披露解释性公告第1号一一非经常性损益》中列举的非经常性损益项目界定为经常性损益的项目的情形。

(三) 主要会计数据和财务指标发生变动的情况及原因

■

二、股东信息

(一) 普通股股东总数和表决权恢复的优先股股东数量及前十名股东持股情况表

单位:股

■

注:前10名股东中荣盛石化股份有限公司回购专用证券账户359,376,623股,占公司总股本比例为3.55%。

(二) 公司优先股股东总数及前10名优先股股东持股情况表

□适用 √不适用

三、其他重要事项

□适用 √不适用

四、季度财务报表

(一) 财务报表

1、合并资产负债表

编制单位:荣盛石化股份有限公司

2023年09月30日

单位:元

■

法定代表人:李水荣 主管会计工作负责人:王亚芳 会计机构负责人:张绍英

2、合并年初到报告期末利润表

单位:元

■

法定代表人:李水荣 主管会计工作负责人:王亚芳 会计机构负责人:张绍英

3、合并年初到报告期末现金流量表

单位:元

■

(二) 2023年起首次执行新会计准则调整首次执行当年年初财务报表相关项目情况

√适用 □不适用

■

(三) 审计报告

第三季度报告是否经过审计

□是 √否

公司第三季度报告未经审计。

荣盛石化股份有限公司董事会

2023年10月25日

Stock Code: 002493 Stock Abbreviation: Rongsheng Petrochemical Announcement No.: 2023-078

Rongsheng Petrochemical Co., Ltd.

2023 Third Quarterly Report

■

Important notice:

1. The Board of Directors, the Board of Supervisors and the directors, supervisors and senior management confirm that the contents in this quarterly report are true, accurate, and complete and have no false representations, misleading statements or material omissions, and they shall severally and jointly accept legal responsibility for such contents.

2. The chairman of the Company, the person in charge of the Company’s accounting and the person in charge of the accounting firm (accounting officer), hereby make representations in respect of the truthfulness, accuracy and completeness of the financial statements in this quarterly report.

3. Whether the Third Quarterly Report has been audited

□Yes √No

I. Key Financial Data

(I) Key accounting data and financial indicators

Whether the Company needs to retroactively adjust or restate prior years’ accounting data

√Yes □No

Reasons for retroactive adjustment or restatement

Changes in accounting policies

■

Reasons for changes in accounting policies and correction of accounting errors

Effective January 1, 2023, the Company implemented the provisions of ASBE Interpretation No. 16, “Accounting for Deferred Taxes on Assets and Liabilities Arising from Individual Transactions Not Subject to the Initial Recognition Exemption” issued by the Ministry of Finance of the People’s Republic of China, and adjusted individual transactions subject to the provisions of ASBE Interpretation No. 16 for those transactions occurring between the beginning of the earliest period of the financial statements in which the provisions of ASBE Interpretation No. 16 were first implemented and the date of the first implementation of ASBE Interpretation No. 16. For lease liabilities and right-of-use assets recognized at the beginning of the earliest period for the presentation of financial statements in which the provisions were first implemented that gave rise to taxable temporary differences and deductible temporary differences as a result of a single transaction to which the provisions apply, the cumulative effect was adjusted to retained earnings at the beginning of the earliest period for which the financial statements were presented, as well as to other relevant financial statement items in accordance with the provisions of ASBE No. 18, “Accounting for Income Taxes”. These changes in accounting policy affected the Company’s balance sheet items at the end of the previous year: deferred tax assets affected were RMB32,682,430.07, deferred tax liabilities affected were RMB31,381,802.53, undistributed earnings affected were RMB1,300,627.54; and the income statement items of January-September 2022: income tax expenses affected were RMB427,199.33.

(II) Items and amounts of non-recurring gain and loss

Unit: RMB

■

Other gain/loss items falling within the definition of non-recurring gain or loss:

□Applicable √Not applicable

The Company has no other gain/loss items falling within the definition of non-recurring gain or loss.

Explanation of the circumstances in which the non-recurring gain and loss items listed in the Explanatory Announcement No. 1 on Information Disclosure of Companies Publicly Issuing Securities-Non-recurring Gains and Losses are defined as recurring gains and losses.

□Applicable √Not applicable

The Company has no explanation of the circumstances in which the non-recurring gain and loss items listed in the Explanatory Announcement No. 1 on Information Disclosure of Companies Publicly Issuing Securities-Non-recurring Gains and Losses are defined as recurring gains and losses.

(III) Changes in key accounting data and financial indicators and reasons thereof

■

II. Shareholders’ Information

(I) Total number of ordinary shareholders and number of preferred shareholders with voting rights restored and top ten shareholders’ shareholdings

Unit: share

■

Note: Among the top 10 shareholders, Rongsheng Petrochemical Co., Ltd. held 359,376,623 shares in its special securities account for repurchase, accounting for 3.55% of the Company’s total share capital.

(II) The total number of preferred shareholders of the Company and the shareholdings of the top 10 preferred shareholders

□Applicable √Not applicable

III. Other Important Matters

□Applicable √Not applicable

IV. Quarterly Financial Statements

(I) Financial statements

1. Consolidated balance sheet

Prepared by: Rongsheng Petrochemical Co., Ltd.

September 30, 2023

Unit: RMB

■

Legal representative: Li Shuirong Person in charge of accounting: Wang Yafang Person in charge of the accounting firm: Zhang Shaoying

2. Consolidated statement of income from the beginning of the year to the end of the reporting period

Unit: RMB

■

Legal representative: Li Shuirong Person in charge of accounting: Wang Yafang Person in charge of the accounting firm: Zhang Shaoying

3. Consolidated statement of cash flows from the beginning of the year to the end of the reporting period

(下转103版)