(上接45版)

(上接45版)

Whether significant variances exist between the above financial index or the index with its sum and the financial index of the quarterly report as well as semi-annual report index disclosed by the Company.

□ Yes √No

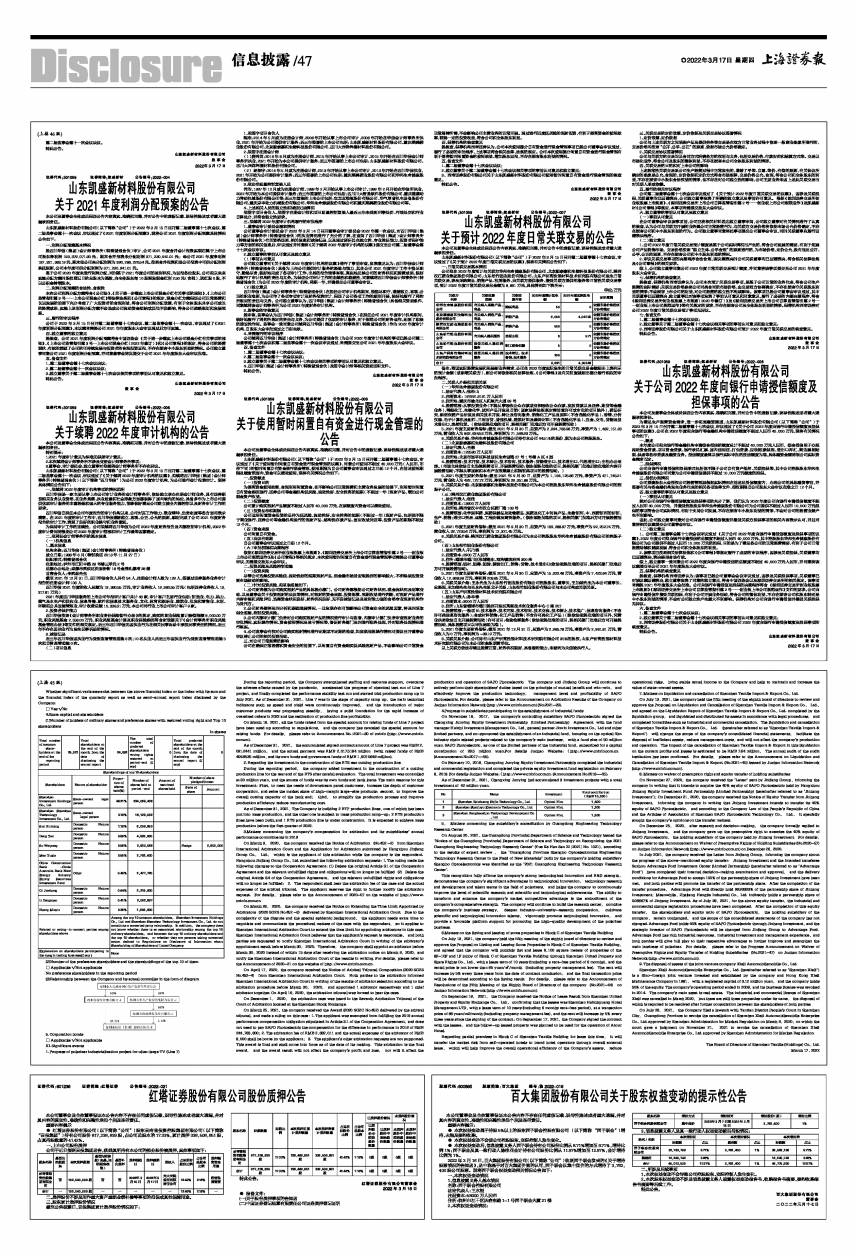

4.Share capital and shareholders

(1)Number of holders of ordinary shares and preference shares with restored voting right and Top 10 shareholders

In shares

■

(2)Number of the preference shareholders and the shareholdings of the top 10 of them

□ Applicable √Not applicable

No preference shareholders in the reporting period

(3)Relationship between the Company and its actual controller in the form of diagram

■

5. Corporation bonds

□ Applicable √Not applicable

III. Significant events

1. Progress of polarizer industrialization project for ultra-large TV (Line 7)

During the reporting period, the Company strengthened staffing and resource support, overcame the adverse effects caused by the pandemic, accelerated the progress of chemical test run of Line 7 project, and finally completed the performance stability test run and started trial production ramp up in July 2021. As of December 31, 2021, Line 7 was in the stage of capacity ramp up, the main technical indicators such as speed and yield were continuously improved, and the introduction of major customer products was progressing steadily, laying a solid foundation for the rapid increase of oversized orders in 2022 and the realization of production line profitability.

On March 16, 2021, all the funds raised from the special account for raising funds of Line 7 project have been used up according to regulations, and the company has canceled the special account for raising funds. For details, please refer to Announcement No.:2021-30 of cninfo (http://www.cninfo.com.cn).

As of December 31, 2021, the accumulated signed contract amount of Line 7 project was RMB 2,091.2441 million, and the actual payment was RMB 2,017.5184 million (with raised funds of RMB 409.9535 million, and its own funds and government funds of RMB 1,607.5649 million).

2. Regarding the investment in the construction of the RTS rear cutting production line

During the reporting period, the company added investment in the construction of a cutting production line for the rear end of the RTS after careful evaluation. The total investment was controlled at 30 million yuan, and the source of funds was its own funds and bank loans. The main reasons for this investment: First, to meet the needs of downstream panel customers, increase the depth of customer cooperation, and seize the market share of high-margin large-size products; second, to improve the overall cutting capacity of the back end; third, to simplify the production process and improve production efficiency. reduce manufacturing cost.

As of December 31, 2021, The Company is building 2 RTP production lines, one of which has been put into mass production, and the other one is subject to mass production ramp-up; 2 RTS production lines have been built,and 1 RTS production line is under construction. It is expected to achieve mass production before the first quarter of 2022.

3.Matters concerning the company's compensation for arbitration and its subsidiaries' annual performance commitments in 2019

On March 9, 2020, the company received the Notice of Arbitration (No.452 -2) from Shenzhen International Arbitration Court and the Application for Arbitration submitted by Hangzhou Jinjiang Group Co., Ltd., which is the applicant of this arbitration while the company is the respondent. Hangzhou Jinjiang Group Co., Ltd. submitted the following arbitration requests: 1. The ruling made the following changes to the Cooperation Agreement: (1) Delete the original Article 3.1 of the Cooperation Agreement and the relevant unfulfilled rights and obligations will no longer be fulfilled (2) Delete the original Article 6.4 of the Cooperation Agreement, and the relevant unfulfilled rights and obligations will no longer be fulfilled; 2. The respondent shall bear the arbitration fee of the case and the actual expenses of the arbitral tribunal. The applicant reserves the right to further modify the arbitration request. For details, please refer to the Announcement of 2020-07 on the website of http://www.cninfo.com.cn.

On March 26, 2020, the company received the Notice on Extending the Time Limit Appointed by Arbitrators (2020 SGZS No.452 -3) delivered by Shenzhen International Arbitration Court. Due to the complexity of the dispute and the special epidemic background, the applicant needs extra time to negotiate and communicate the procedural matters of the case with the respondent, so it applies to Shenzhen International Arbitration Court to extend the time limit for appointing arbitrators in this case. Shenzhen International Arbitration Court believes that the applicant's request is reasonable, and both parties are requested to notify Shenzhen International Arbitration Court in writing of the arbitrator's appointment result before March 30, 2020. Therefore, the company shall appoint an arbitrator before March 30, 2020 instead of within 15 days after receiving the arbitration notice on March 9, 2020, and notify the Shenzhen International Arbitration Court of the results in writing. For details, please refer to the Announcement of 2020-21 on the website of http://www.cninfo.com.cn.

On April 17, 2020, the company received the Notice of Arbitral Tribunal Composition (2020 SGZS No.452-4) from Shenzhen International Arbitration Court. Both parties to the arbitration informed Shenzhen International Arbitration Court in writing of the results of arbitrator selection according to the arbitration procedure before March 30, 2020, and appointed 1 arbitrator respectively and 1 chief arbitrator together. On April 16, 2020, the arbitration tribunal was formed to hear the case.

On December 1, 2020, the arbitration case was heard in the Seventh Arbitration Tribunal of the Court of Arbitration located at the Shenzhen Stock Exchange.

On March 25, 2021, the company received the Award (2020 SGZC No.452) delivered by the arbitral tribunal, and made a ruling on this case: 1. The applicant was exempted from fulfilling the 2019 annual performance compensation obligation stipulated in Article 3.1 of the Cooperation Agreement, and does not need to pay SAPO Photoelectric the compensation for the difference in performance in 2019 of RMB 244,783,800; 2. The arbitration fee of RMB 2,682,011 and the actual expenses of the arbitrator of RMB 8,000 shall be borne by the applicant; 3. The applicant's other arbitration requests are not supported. This award is final and shall come into force as of the date of its making. This arbitration is the final award, and the award result will not affect the company's profit and loss, nor will it affect the production and operation of SAPO Photoelectric. The company and Jinjiang Group will continue to actively perform their shareholders' duties based on the principle of mutual benefit and win-win, and effectively improve the production technology, management level and profitability of SAPO Photoelectric. For details, please refer to the Announcement on Arbitration Results of the Company on Juchao Information Network (http://www.cninfo.com.cn) (No.2021-29).

4.Progress in subsidiaries participating in the establishment of industrial funds

On November 16, 2017, the company's controlling subsidiary SAPO Photoelectric signed the Changxing Junying Equity Investment Partnership (Limited Partnership) Agreement with the fund manager Huizhi Investment Management Co., Ltd, general partner Jinxin Investment Co., Ltd and other limited partners, and co-sponsored the establishment of an industrial fund, focusing on the optical film industry chain related projects related to the company's main business, with a fund size of 50 million yuan. SAPO Photoelectric, as one of the limited partners of the industrial fund, subscribed for a capital contribution of 28.5 million yuan.For details Juchao Website:(http://www.cninfo.com.cn. (Announcement No.2017--55).

On February 10, 2018, Changxing Junying Equity Investment Partnership completed the industrial and commercial registration and completed the private equity investment fund registration on February 8, 2018. For details Juchao Website:(http://www.cninfo.com.cn. (Announcement No.2018--05).

As of December 31, 2021, Changxing Junying had accumulated 3 investment projects with a total investment of 42 million yuan.

■

5, Matters concerning the subsidiary's accreditation by Guangdong Engineering Technology Research Center

On August 20, 2021, the Guangdong Provincial Department of Science and Technology issued the "Notice of the Guangdong Provincial Department of Science and Technology on Recognizing the 2021 Guangdong Engineering Technology Research Center" (Yue Ke Han San Zi [2021] No. 1021), according to the results of expert review , the "Guangdong Province Shengbo Optoelectronics Engineering Technology Research Center in the Field of New Materials" built by the company's holding subsidiary Shengbo Optoelectronics was identified as the "2021 Guangdong Engineering Technology Research Center".

This recognition fully affirms the company's strong technological innovation and R&D strength, demonstrates the company's significant advantages in technological innovation, technology research and development and talent teams in the field of polarizers, and helps the company to continuously improve the level of scientific research and scientific and technological achievements. The ability to transform and enhance the company's market competitive advantage is the embodiment of the company's comprehensive strength. The company will continue to build the research center, combine the company's business strategy, deepen industry-university-research cooperation, cultivate scientific and technological innovation talents, vigorously promote technological innovation, and provide a favorable platform support for promoting the high-quality development of the polarizer business.

6.Matters on the listing and leasing of some properties in Block C of Shenzhen Textile Building

On July 13, 2021, the company held the fifth meeting of the eighth board of directors to review and approve the Proposal on Listing and Leasing Some Properties in Block C of Shenzhen Textile Building, and agreed that the company will publicly list and lease 6,100 square meters of properties of the 8F-10F and 1F lobby of Block C of Shenzhen Textile Building through Shenzhen United Property and Share Rights Co., Ltd., with a lease term of 10 years (including a rent-free period of 6 months), and the rental price is not lower than 85 yuan/㎡/month (including property management fee). The rent will increase by 5% every three years from the date of contract conclusion, and the final transaction price will be determined according to the listing result. For details, please refer to the Announcement of Resolutions of the Fifth Meeting of the Eighth Board of Directors of the company (No.2021-44) on Juchao Information Network (http://www.cninfo.com.cn).

On September 18, 2021, the Company received the Notice of Lease Result from Shenzhen United Property and Equity Exchange Co., Ltd., confirming that the lessee was Shenzhen Haizhiguang Hotel Management LTD, with a lease term of 10 years (including 6 months rent-free period), at a transaction price of 86 yuan/m2/month (including property management fee), and the rent will increase by 5% every three years since the signing of the contract; On September 17, 2021, the Company signed the contract with the lessee, and the follow-up leased property was planned to be used for the operation of Atour Hotel.

Regarding partial premises in Block C of Shenzhen Textile Building for lease this time, it will transfer the market risk from self-operated hotels to brand hotel operators through overall external lease, which will help improve the overall operational efficiency of the Company's assets, reduce operational risks, bring stable rental income to the Company and help to maintain and increase the value of state-owned assets.

7. Matters on liquidation and cancellation of Shenzhen Textile Import & Export Co., Ltd.

On July 13, 2021, the company held the fifth meeting of the eighth board of directors to review and approve the Proposal on Liquidation and Cancellation of Shenzhen Textile Import & Export Co., Ltd., and agreed on the Liquidation Report of Shenzhen Textile Import & Export Co., Ltd.. completed by the liquidation group, and liquidated and distributed its assets in accordance with legal procedures, and completed formalities such as industrial and commercial cancellation. The liquidation and cancellation of Shenzhen Textile Import & Export Co., Ltd. (hereinafter referred to as "Shenzhen Textile Import & Export") will change the scope of the company's consolidated financial statements, facilitate the disposal of inefficient assets, reduce management costs, and will not affect the company's production and operation. The impact of the cancellation of Shenzhen Textile Import & Export in this liquidation on the current profits and losses is estimated to be RMB 7.64 million, The annual audit of the audit institution has been confirmed. For details, please refer to the Announcement on Liquidation and Cancellation of Shenzhen Textile Import & Export. (No.2021-45) issued by Juchao Information Network (http://www.cninfo.com.cn).

8. Matters on waiver of preemption right and equity transfer of holding subsidiaries

On November 27, 2020, the company received the "Letter" sent by Jinjiang Group, informing the company in writing that it intends to acquire the 40% equity of SAPO Photoelectric held by Hangzhou Jinhang Equity Investment Fund Partnership (Limited Partnership) (hereinafter referred to as "Jinhang Investment"); On December 21, 2020, the company received the Notice of Equity Transfer from Jinhang Investment, informing the company in writing that Jinhang Investment intends to transfer its 40% equity of SAPO Photoelectric, and according to the Company Law of the People's Republic of China and the Articles of Association of Shenzhen SAPO Photoelectric Technology Co., Ltd., it specially sought the company's opinions on the transfer matters.

On December 25, 2020, after research and decision-making, the company formally replied to Jinhang Investment, and the company gave up the preemptive right to exercise the 40% equity of SAPO Photoelectric, the holding subsidiary of the company held by Jinhang Investment. For details, please refer to the Announcement on Waiver of Preemptive Rights of Holding Subsidiaries (No.2020-57) on Juchao Information Network (http://www.cninfo.com.cn) on December 26, 2020.

In July 2021, the company received the Letter from Jinjiang Group, informing the company about the progress of the above-mentioned equity transfer: Jinhang Investment and the intended transferee Suzhou Advantage Ford Investment Center (Limited Partnership) (hereinafter referred to as "Advantage Ford") have completed their internal decision-making examination and approval, and the delivery conditions for Advantage Ford to accept 100% of the partnership share of Jinhang Investment have been met, and both parties will promote the transfer of the partnership share. After the completion of the transfer procedure, Advantage Ford will directly hold 99.93333% of the partnership share of Jinhang Investment; Meanwhile, Zhejiang Hengjie Industrial Co., Ltd. indirectly holds a partnership share of 0.06667% of Jinhang Investment. As of July 28, 2021, for the above equity transfer, the industrial and commercial change registration procedures have been completed. After the completion of this equity transfer, the shareholders and equity ratio of SAPO Photoelectric, the holding subsidiary of the company, remain unchanged, and the scope of the consolidated statements of the company has not changed. Advantage Ford holds 40% equity of SAPO Photoelectric through Jinhang Investment, and the strategic investor of SAPO Photoelectric will be changed from Jinjiang Group to Advantage Ford. Advantage Ford has rich industrial resources, industrial investment and management experience, and both parties will give full play to their respective advantages to further improve and strengthen the main business of polarizer. For details, please refer to the Progress Announcement on Waiver of Preemptive Rights and Equity Transfer of Holding Subsidiaries (No.2021-47) on Juchao Information Network (http://www.cninfo.com.cn).

9. The disposal of assets of the joint venture company Xieli Automobilemobile Co., Ltd.

Shenzhen Xieli Automobilemobile Enterprise Co., Ltd. (hereinafter referred to as "Shenzhen Xieli") is a Sino-foreign joint venture invested and established by the company and Hong Kong Xieli Maintenance Company in 1981, with a registered capital of 3.12 million yuan, and the company holds 50% of the equity. The company's operating period ended in 2008, and its business license was revoked in 2014. The company's main asset is real estate. The industrial and commercial license of Shenzhen Xieli was cancelled in March 2020, but there are still three properties under its name, the disposal of which is required to be resolved after further consultation between the shareholders of both parties.

On July 26, 2021, the Company filed a lawsuit with Yantian District People's Court in Shenzhen City, Guangdong Province to revoke the cancellation of Shenzhen Xieli Automobilemobile Enterprise Co., Ltd. approved by Shenzhen Administration for Market Regulation on March 9, 2020, on which the court gave a judgment on November 21, 2021 to revoke the cancellation of Shenzhen Xieli Automobilemobile Enterprise Co., Ltd. approved by Shenzhen Administration for Market Regulation.

The Board of Directors of Shenzhen Textile (Holdings) Co., Ltd.

March 17, 2022